If you live in Germany, you must have health insurance. It pays for your healthcare when you are sick.

You need health insurance to apply for a National Visa or a residence permit, to start a new job, or to study in Germany.

Your options

There is public, private and expat health insurance. The best option depends on your situation.

Public health insurance

87% of Germans have public health insurance.2 It might be your only option.

Public health insurance is run by non-profit insurance funds, not by the state. There are dozens of insurers, but their cost and coverage are almost the same.66

Cost of public health insurance

Public health insurance costs a percentage of your income. The cost does not depend on your age, your health condition, or how often you get sick.

Use my health insurance recommendation tool to calculate the cost.

- If you are an employee

You pay 9.6% to 11.2% of your income (including long-term care insurance). The minimum cost is around €130 per month. The maximum cost is around €650 per month. It comes out of your paycheck every month. - If you are a student

You usually pay the student tariff: around €150 per month. If you are over 30 years old, you can’t get the student tariff, so you pay around €250 per month. - If you are self-employed

You pay 19.2% to 22.6% of your estimated income (including long-term care insurance). The minimum cost is around €250 per month. The maximum cost is around €1,310 per month. You pay for health insurance by bank transfer every month.8 - If you are an apprentice (Azubi)

If you earn less than €325 per month, you get free health insurance. Your employer pays for it.47 If you earn more, you pay the same amount as employees. - If you are unemployed

You pay the minimum amount: around €250 per month. When you lose your job, you sometimes get one month of free health insurance.

Healthcare and medication are usually free. There is sometimes a €5 to €10 deductible for some treatments and prescriptions.54

The cost of public health insurance is tax-deductible.

What public insurance covers

Public health insurance covers all necessary healthcare. It pays for the cheapest treatment that works. There is no limit on the cost of treatments. You can get healthcare as often as you need. It does not get more expensive if you use it often.

Your insurance covers…

- All necessary treatments, therapy and medical prescriptions

- All pre-existing conditions

- Your children and your unemployed spouse (Familienversicherung)

- Long-term sick leave

- Emergency healthcare in other EU countries

- Psychotherapy

- Basic vaccinations7

- Cancer screenings

- Necessary dental care (wisdom tooth removals, 2 dental check-ups per year)11

It does not cover…

- Glasses and contact lenses (there are exceptions)

- Travel vaccinations (some insurers cover them)

- Cosmetic treatments like removing a mole, tooth whitening, orthodontics, nicer tooth fillings1

- Alternative medicine like acupuncture and osteopathy

To get better coverage, get dental insurance or supplementary health insurance, or private health insurance.

When you go to the doctor, you show your insurance card, and they charge your Krankenkasse directly. There is no reimbursement process.4 If a treatment is not covered, you know before you start. There are no surprise costs.

Benefits of public health insurance

- The cost is proportional to your income

If you earn less money, your insurance is cheaper. If you have an unstable income, if you lose your job, or if you retire, your insurance stays affordable. If you just started your business, choose public health insurance.27 - It’s cheap for students

Students under 30 years old pay around €150 per month. If you are under 30 years old, public is usually the best option.51 - It covers your family for free

Your insurance covers your children and your unemployed spouse for free. Private health insurance charges for each person you cover. If you have more than 2 children, public is usually cheaper than private.12 - It’s simple

When you go to the doctor, you show your insurance card, and you get healthcare. You don’t need to worry about coverage, deductibles or reimbursement. There is no paperwork and no surprises; it just works. - The cost is not tied to your health

If you have pre-existing conditions, public is usually the cheapest option.28 Private health insurers usually reject you or charge more. - It’s the safest option

Public health insurance is never a bad decision. Insurers have similar prices and coverage, so you can’t choose wrong. If you change your mind, you can choose another public health insurer, or switch to private health.63 If you choose private health insurance, it’s much harder to change your mind.20

Disadvantages of public health insurance

- High earners pay more

The cost is proportional to your income. If you are young, healthy and well-paid, private health insurance is usually better and cheaper.50 - Doctor appointments are harder to get13

It can take weeks or months to see a specialist. Psychotherapists, psychiatrists, gynaecologists, paediatricians and urologists that accept public health insurance are hard to find. If you want to see a doctor quickly, choose private health insurance. - Special treatments are not covered

It covers the cheapest treatment that works.42 To get better treatments and better coverage, choose private health insurance.62 - It’s not available to everyone

If you are self-employed or a student over 30, you can’t get public health insurance. You must get private or expat health insurance instead. There are some exceptions.

Best public health insurance

Public health insurers have almost the same cost and coverage.66 The price difference is less than €20 per month after taxes. Look for better customer service and coverage of specific treatments.15 For example, one insurer can have better coverage for pregnancy, eyeglasses, dental care or travel vaccinations.

Techniker Krankenkasse and Barmer speak English. Most people choose them. Techniker Krankenkasse is cheaper, and it’s really good.

If you are not sure, ask my insurance expert. It’s free.

Private health insurance

You can choose private health insurance if…

- You are an employee, and you earn more than €77,400 per year3

- or you are self-employed and you earn more than €35,000 per year46

- or you are a student

- or you are a civil servant (Beamter)31

Use my recommendation tool to see if you qualify. Everyone else must choose public health insurance. Only 13% of Germans have private health insurance.2

Cost of private health insurance

Use my recommendation tool to get a price estimate.

The cost depends on…

- Your age when you join

Younger people pay less. Your insurer saves a part of your payments for old age. If you join when you are young, you also pay less when you are old. If you plan to leave Germany after a few years, you can get insurance without old-age provisions. It’s around 50% cheaper. - Your health condition when you join

If you have no health insurance history, you must get a health check at the doctor.43 If you have pre-existing health conditions, insurers reject you or charge more.9 After you join, your health does not affect the price, even if you get really sick. - The coverage you choose

You can choose the best coverage or the lowest price. To cover your spouse and children, you must pay more. You can pay more to get a higher sickness allowance. - Your deductible

If you choose a high deductible (up to €3,000 per year), you pay less. You also get a yearly discount if you don’t use your health insurance.17 I get around €650 back every year.

Your employer pays half of your health insurance. If you are self-employed or a student, you pay the full price yourself.18 You pay every month by bank transfer.8

The cost of private health insurance is tax-deductible.

Benefits of private health insurance

- It’s better and cheaper for high earners19

If you are young, healthy and well-paid, private is usually better and cheaper than public. I save around €600 per month. - Easier doctor appointments

You can see a doctor faster. You get an appointment with a specialist in days instead of weeks. Try it yourself! Go on Doctolib, and try to find a doctor appointment with public and with private health insurance. - Better treatments

Private clinics usually have better service. Doctors take the time to listen to you.25 They also prescribe the best treatment instead of trying cheaper options first. - You choose your coverage

You can pay more to get the best coverage, or pay less to save money. If you are young and healthy, you can get really cheap health insurance. - You pay less when you don’t use it

Many private health insurers have a no-claims bonus. If you don’t use your health insurance, you get money back every year. If you never get sick, you can save a lot of money. In 2024, I got a €640 refund.

Disadvantages of private health insurance

- If your income changes, the cost stays the same

If you lose your job, if you go on parental leave, if your business fails or if you retire, your health insurance does not get cheaper. You can be stuck with expensive health insurance. Public health insurance is safer, because the cost is proportional to your income. - It makes you avoid seeing a doctor

If you have a deductible, you pay for most healthcare yourself. You might ignore a small problem because it costs €70 to see a doctor. You also get a yearly refund if you don’t use your insurance. It makes you avoid healthcare to save money. - You pay, then get reimbursed

When you go to the doctor, you pay for the treatment, and your insurance pays you back later. It’s more effort and more paperwork. You need enough money to pay the doctor. You must also check if your insurance covers your treatment, or you will not get reimbursed.39 Doctors often prescribe unnecessary treatments to private patients. For big, expensive treatments, the insurance company pays the doctor directly. - You can be stuck with private

If you choose private, it’s hard to change your mind.20 It’s really hard to switch to public health insurance, or to another private insurance. You can be stuck with expensive private health insurance. Always ask an expert before you choosing private; it’s a very serious decision. - They reject people

If you have a pre-existing condition, insurers usually reject you.57 They reject people because of psychotherapy, severe asthma, diabetes, obesity and many other things. They usually reject you if you are self-employed and your income is below €35,000 per year.48 After you join, they can’t kick you out.

What private insurance covers

It always covers necessary healthcare. The coverage is usually equal or better to public health insurance. You can choose the coverage you want.

The overall coverage is unlimited. There is no yearly cost limit. If you get cancer and the treatment costs millions of euros, your insurance pays for everything. Some treatments might have deductibles or yearly limits. For example, some plans have coverage limits for psychotherapy.52 Ask our expert to find a plan that suits your needs.

You can customize your coverage. You can pay more to cover dental care, eyeglasses and laser eye surgery. It can cover better dental implants, a better wheelchair, or a better hospital room. If you prefer to pay less every month, you can get lower coverage.

Sickness allowance is not included. You must pay extra for it. I recommend it.

Best private health insurance

There is no best private health insurance. There are thousands of options. The best option depends on your situation and your budget.

Do not choose private health insurance yourself. It’s a really bad idea. Ask a health insurance broker to compare all options and help you choose. Their help is free.

Ottonova sells their own private health insurance. It’s rarely the best option.59 Don’t choose Ottonova directly; ask our expert first. If Ottonova is the best option for you, they will tell you.58

Feather sells private health insurance from multiple companies.40

Expat health insurance

Expat health insurance (or incoming health insurance) is a temporary private health insurance. It’s cheap, but it’s bad.

Only choose expat health insurance if…

- You need temporary coverage

Use it to apply for a National Visa, for temporary stays in Germany, or to cover medical emergencies before your public health insurance coverage starts. - or you are a student over 30 years old

It’s the cheapest option. Switch to public or private health insurance when you graduate and start working. If you are under 30 years old, choose public health insurance. - or you are a freelancer with a low income

You can use it to apply for a first freelance visa for the first time.6 It might be your only option. Ask our expert if it’s the correct choice. It’s rarely accepted when you renew your freelance visa. - or you are retired

If you move from a non-EU country, it might be your only option. Public and private insurers might reject you. Ask our expert if it’s the correct choice.

Do not stay on expat health insurance. It’s a temporary insurance. It’s only valid for up to 5 years. If you develop a health condition while you have expat insurance, it can be impossible to find long-term health insurance. Get public or private health insurance as soon as you can.

Disadvantages of expat health insurance

- It’s not always accepted

It’s valid for a Schengen visa or a National Visa application.5 It’s rarely valid to change or renew a residence permit.29 - The coverage is limited

It does not cover pre-existing health conditions. It rarely covers psychotherapy, dentist visits, health check-ups and preventative treatments.26 There are high deductibles for some treatments. There are limits on the cost of some treatments. - You pay, then get reimbursed

When you go to the doctor, you pay for the treatment, and your insurance pays you back later. It’s more effort and more paperwork. You need enough money to pay the doctor. You must also check if your insurance covers your treatment, or you will not get reimbursed. - It’s temporary

You can rarely use it for more than 5 years.22 When it expires, you must get public or private health insurance. If you have developed health problems during that time, it can be impossible to find another health insurance. - It gets very expensive

The price increases every year. There is no limit on the price increases. In the long term, public and private health insurance are cheaper.10

Best expat health insurance

These options are valid for a National Visa application. You can use them to apply for your first student visa, freelance visa, opportunity card, or other Category D visas. They are accepted by German embassies, consulates and immigration offices.

- Feather

Their insurance is valid for a National Visa application. They also sell public and private health insurance from multiple insurers. I work with them since 2018. - HanseMerkur and Advigon

The Basic and Profi plans are valid for a National Visa application. The Profi plan is a better choice, because it covers some preventative care.45 - April International

- Care Concept

- Dr Walter

- Ottonova

- Mawista – Not recommended. They often reject reimbursement claims.

Expatrio, Fintiba and Coracle sell packages that include a blocked account, expat health insurance and public health insurance. Their expat health insurance is valid for a National Visa application.

If you are not sure, ask my insurance expert to help you choose.

Other options

Free health insurance

Your parents’ insurance covers you for free if…

- Your parents have public health insurance

- and you are under 23 years old (25 years old if you are a student)

- and your total income is under €565 per month (€602 per month for a minijob)

- and you are not self-employed full time

- and you are not an apprentice (Azubi)49

Your spouse’s insurance covers you for free if…34

- Your spouse has public health insurance

- and your total income is under €565 per month (€602 per month for a minijob)

- and you are not self-employed full time36

- and you are not a apprentice (Azubi)49

Your health insurance from another EU country covers you if…

- You are visiting Germany

- or you are a student and you have no income41

Your employer pays for your health insurance if…47

- You are an apprentice (Azubi)

- and you earn less than €325 per month

The state pays for your public health insurance if…44

- You get unemployment benefits

- or you get Bürgergeld

- or you get Elterngeld (in some cases)

When you lose your job, your public health insurance is sometimes free for 1 month (nachgehender Leistungsanspruch). This happens automatically; you don’t need to apply for it.

Travel health insurance

Travel health insurance covers medical emergencies in other countries. It does not cover psychotherapy, long-term treatments, health check-ups or pre-existing health conditions.

- If you visit Germany

Travel health insurance covers you during your trip. You need it to apply for a Schengen visa. If you have visa-free entry, travel health insurance is optional but recommended. HanseMerkur Visa Plus is valid for a Schengen visa application. - If you move to Germany

You need travel or expat health insurance for your National Visa application. It covers you until your public or private health insurance starts. If you have visa-free entry, travel health insurance is optional but recommended. HanseMerkur Visa Plus is valid for a National Visa application. - If you live in Germany

It covers medical emergencies in other countries. It costs around €40 per year.60 Get it from Feather, Envivas or Allianz. Your private health insurance or your bank account might include travel insurance.

Health insurance for a visa application

Insurance from other EU countries

If you come from another EU country, your foreign health insurance might cover you in Germany. You can use your European Health Insurance Card to get healthcare.

- If you visit Germany

Your EU health insurance covers medical emergencies.23 It only covers treatments that can’t wait until you go home. For example, if you break your ankle on a hike, it covers the hospital visit. If you stay longer than 3 months, you must get German health insurance.37 - If you study in Germany

Your EU health insurance covers you until you graduate, and during your job search after graduation.38 It covers all treatments that can’t wait until after your studies.

If health insurance is cheaper in your home country, EHIC is a good way to save money, because you don’t need German health insurance. Apply for EHIC with your health insurance in your home country.16

You can only get treatments that are covered by German public health insurance.32 It does not cover repatriation if you are sick. For that, you need travel health insurance.24

If you start working in Germany, your EHIC stops working, and you must get German health insurance.41

What is the best option?

- Public health insurance is the safest option, because you can change your mind later.63 Public health insurers have very similar prices and coverage, so you can’t choose wrong. The cost is proportional to your income.

- Private health insurance is a risky decision, but it can be better and cheaper than public. If you are not happy, it’s really hard to switch to public health insurance. Never choose private health insurance yourself.

- Expat health insurance is a temporary option. It’s cheap, but the coverage is bad. Use it when you have no other choice.

Choose public health insurance if…

- You have a low or unstable income

It costs a percentage of your income. If you earn less, you pay less. If you just started your business or you make less than €35,000 per year, choose public health insurance.27 - You prefer something simple

Just show your card and get healthcare. It takes longer to get an appointment, but you don’t have to deal with paperwork, deductibles or the reimbursement process. - You want a big family

Public health insurance covers your children for free. It’s usually cheaper than private health insurance if you have many children.12 - You are a student under 30 years old

Students pay a lower price, so it’s a really good deal.51 Expat health insurance is still cheaper, but it covers a lot less. - You have a pre-existing condition

You pay the same price, even if you are really sick. Private health insurers would charge more or refuse to cover you.

Choose private health insurance if…

- You have a high, stable income

It’s be cheaper than public health insurance, because the cost is not based on your income. - You want faster doctor appointments

It’s much easier to find a doctor, a psychotherapist, a paediatrician or a gynaecologist. It takes a few days instead of a few weeks. - You want better treatments

You can pay more for better coverage. For example, you can choose a specific doctor, or a specific kind of treatment. You can get innovative therapy or medication that is not covered by public health insurance.55 It can cover better dental implants, a better wheelchair, or a better hospital room. - You plan to leave Germany in a few years

You can get short-term private health insurance. It’s much cheaper, because there is no old-age provision.56 - You can’t choose public health insurance

If you are a freelancer or a student from a non-EU country, public health insurers might reject you. Private health insurance might be your only option.

Choose expat health insurance if…

- You need temporary insurance coverage

Expat health insurance covers from the day you arrive in Germany until the day you start working or studying. You usually need it to apply for a National Visa. - You are a student over 30 years old

For some foreign students, it’s the only option. Public health insurance might reject you. - You have no other choice

If you are self-employed and you have a pre-existing health condition, it might be your only option. Expat health insurance is usually the cheapest option. It’s a bad long-term solution, but it might be the only insurance you can afford. - You apply for an opportunity card

Expat health insurance is perfect for this. When you find a job, switch to public or private health insurance.

Choose travel health insurance if…

- You are a tourist

Travel insurance covers medical emergencies while you travel. It’s cheap. - You apply for a Schengen visa

You need valid health insurance to apply for the Schengen visa. HanseMerkur Visa Plus works well for this.

Best option by occupation

- For a visa application

- For employees

- For students

- For freelancers

- For apprentices (Azubis)

- When unemployed

How to get insured

1. Understand your options

Use my recommendation tool to know your options. There are 3 types of health insurance and hundreds of options. The best option depends on your situation. If you apply for a National Visa, you might need a combination of insurances.

2. Ask our expert

If you choose public health insurance, you can’t go wrong. All options are similar. Their cost and coverage are almost the same. TK and Barmer are good English-speaking options. You can change your mind and switch to private health insurance later.

If you choose expat health insurance for a National Visa application, get one of the recommended options. If you choose long-term expat health insurance, ask an expert first. It’s cheap now, but it can be an expensive mistake later. Many freelancers make that mistake.

If you choose private health insurance, always ask an expert. Don’t trust comparison portals like Check24. An expert will ask you the right questions, compare all options, and help you find the best health insurance.

If you are self-employed, always ask an expert. Freelance visa applications are often rejected because of invalid insurance. Freelancers often choose the cheapest option and regret it later.

If you are not sure, ask an expert to help you decide. Their help is free.

3. Apply for health insurance

The process is different with each insurer. Your health insurance broker can take care of this.

You only need an ID document and a photo for your insurance card. You do not need a German address or an Anmeldung.53

- If you choose expat health insurance, you get insured in a few minutes.

- If you choose public health insurance, you can get your proof of health insurance on the same day, and your insurance card in 2 to 4 weeks. It takes longer for freelancers.33 You can get healthcare before your insurance card arrives.

- If you choose private health insurance, it takes around 2 weeks. You usually need a health check from a doctor.43 It costs around €250.30

If you are self-employed and new in Germany, it can be hard to get health insurance. Public and private health insurers can reject you. You might need to try multiple insurers. I strongly recommend asking an expert to help you.

4. Get your documents

Once you are insured, you get…

- A health insurance card

When you go to the doctor, bring it with you. It’s also a proof of health insurance when you travel to other EU countries. It arrives in 2 to 4 weeks, but you can get healthcare without it.14 - A Mitgliedsbescheinigung

It’s a proof of health insurance. Use it to apply for a National Visa or a residence permit. - A Sozialversicherungsnummer

Give it to your employer. If you get private health insurance, you do not get a Sozialversicherungsnummer automatically. Your employer can also request it for you.61 You can also contact the Deutsche Rentenversicherung and ask for it.

If you are a student, your health insurer will tell your school that you are insured (the M10 Meldung). It’s done digitally; you don’t need to do anything. It takes around 3 days.67

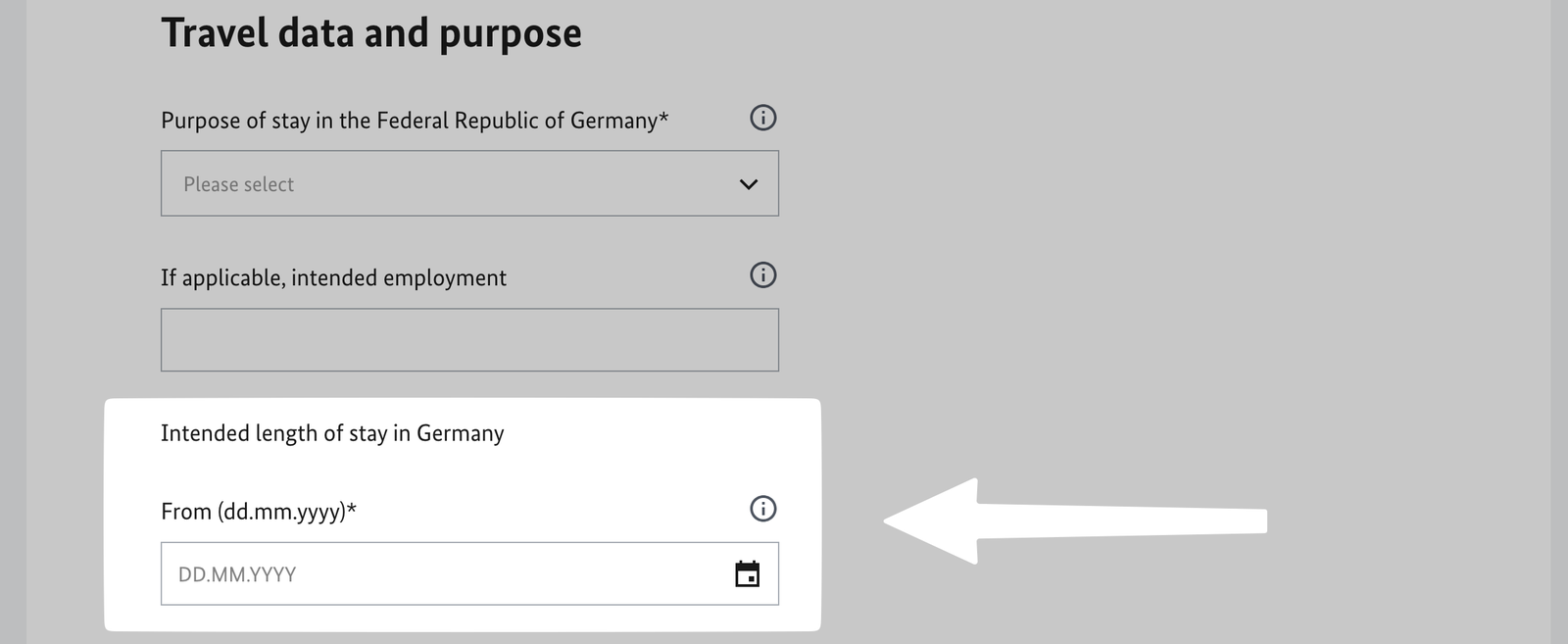

If you apply for a National Visa, you must upload two documents to the Consulate Service Portal: a proof of incoming health insurance, and a proof of long-term health insurance. Merge them together, and upload them under “Proof of health insurance”.

Your incoming health insurance must cover you from the day you arrive in Germany. It must match the arrival date in the Consular Services Portal.

5. Pay every month

If you have public health insurance, you pay out of your paycheck every month. If you have private health insurance or you are self-employed, you pay by bank transfer or direct debit authorisation.35 You might need to open a bank account for this.

When you are self-employed, the cost of public health insurance is based on your estimated income. Every year, you must prove your real income, and your insurer adjusts the cost of your health insurance. If you paid too much, you get money back. If you did not pay enough, you must make an extra payment.21

What to do next

- Tell your employer

When you change your health insurance, your employer must know.65 Tell the human resources department. - Open a bank account

You pay for health insurance by bank transfer. If you are an employee, you pay directly out of your paycheck, but you need a bank account to receive your paycheck. - Get liability insurance

It’s the second most important insurance. Most Germans have it. I got mine from Feather. It costs €5 per month. - Get travel health insurance

It covers you when you travel outside of Germany. It costs €25 to €40 per year.60 You can get travel insurance from Feather, Envivas or Allianz. Your private health insurance might include travel insurance. Some banks accounts like N26 Metal include travel insurance. - Become an organ donor

It’s really easy. It can save another person’s life. - Get job disability insurance

It gives you an income if you can’t work anymore because of a disability. It’s recommended if you have a family or a mortgage. It costs €50 to €150 per month.

Need help?

Our insurance expert answers your questions and helps you choose health insurance. It’s a free service.

Choose a broker who works with immigrants. Your needs are different, and your broker must know how to help you.

Talk to a broker (Makler), not an agent (Vertreter). Brokers are independent. They recommend health insurance from different companies. Agents only sell insurance from specific companies.

Feather now sells private health insurance from all providers, just like a broker. They have a lot of experience with immigrants, and they speak English.

Ottonova sells their own insurance. It’s rarely the best option.64 If you choose Ottonova, get it through our expert. If there is a better option, they will tell you.

Sources and footnotes

-

verbraucherzentrale.de (March 2025) ⤴

-

gesundheitsinformation.de, gkv-spitzenverband.de, verwaltung.bund.de (April 2025) ⤴

-

krankenkassen.de (July 2025) ⤴

-

Emily Archer (April 2025), Feather (April 2025) ⤴

-

Emily Archer (April 2025) ⤴

-

krankenkassen.de (June 2025) ⤴

-

Seamus Wolf (April 2025) ⤴

-

FinanXpats (April 2025), Feather Insurance (April 2025) ⤴

-

verbraucherzentrale.de (March 2025) ⤴

-

Seamus Wolf (April 2025), Mona Anbari (April 2025), Emily Archer (April 2025), finanztip.de (January 2025), FinanXpats (April 2025) ⤴

-

arzt-wirtschaft.de (2024), sueddeutsche.de (2024), study (2013) ⤴

-

Seamus Wolf (August 2025) ⤴

-

Seamus Wolf (April 2025) ⤴

-

Feather Insurance (April 2025) ⤴

-

Seamus Wolf (June 2025) ⤴

-

Personal experience (2020) ⤴

-

care-concept.de (April 2025), mawista.com (April 2025), Feather Insurance (April 2025) ⤴

-

health-insurance.de (April 2025), ec.europa.eu (April 2025) ⤴

-

dvka.de, Seamus Wolf (April 2025) ⤴

-

Mona Anbari (April 2025) ⤴

-

finanztip.de (January 2025), Feather Insurance (April 2025), Emily Archer says that the amount is not fixed, but that insurers need to see that you can cover your insurance bills (April 2025) ⤴

-

finanztip.de (January 2025), Mona Anbari (April 2025) ⤴

-

Emily Archer (April 2025), multiple relocation consultants (2025) ⤴

-

Seamus Wolf (April 2025), Emily Archer (April 2025) ⤴

-

verwaltung.bund.de (April 2025) ⤴

-

Rob Schumacher (September 2025) ⤴

-

verbraucherzentrale.de (January 2025) minijob-zentrale.de (February 2025) ⤴

-

Personal experience (2025), Seamus Wolf (April 2025) ⤴

-

verbraucherzentrale.de (February 2025) ⤴

-

Feather Insurance (2023) ⤴

-

Feather Insurance (2023), Feather Insurance (May 2025), krankenkassen.de (May 2025) ⤴

-

Rob Schumacher at Feather (October 2025) ⤴

-

feather-insurance.com (2023), verwaltung.bund.de (April 2025), uni-frankfurt.de (May 2025) ⤴

-

Mona Anbari (April 2025) ⤴

-

Seamus Wolf (April 2025), Emily Archer (April 2025) ⤴

-

Techniker Krankenkasse (May 2025), familienportal.de (May 2025) ⤴

-

Seamus Wolf (October 2025) ⤴

-

Technically, it’s possible with a lower income, but no insurer will accept you. Seamus Wolf (November 2025) ⤴

-

AOK (March 2025), Check24 (March 2025), Techniker Krankenkasse (March 2025) ⤴

-

Seamus Wolf (November 2025) ⤴

-

gesetzliche-krankenkassen.de (March 2025) ⤴

-

Seamus Wolf (April 2025), finanztip (February 2025), verbraucherzentrale.de (2024) ⤴

-

finanztip.de (January 2025), Feather Insurance (May 2025) ⤴

-

Seamus Wolf (April 2025) ⤴

-

Seamus Wolf (May 2025) ⤴

-

online-pkv.de (January 2025), gesetzlichekrankenkassen.de (June 2025) ⤴

-

Mona Anbari (April 2025) ⤴

-

Seamus Wolf (April 2025) ⤴

-

Seamus Wolf (April 2025) ⤴

-

Seamus Wolf (April 2025) ⤴

-

Seamus Wolf (April 2025) ⤴

-

Feather Insurance, Seamus Wolf (April 2025) ⤴

-

Emily Archer (April 2025) ⤴

-

Mona Anbari (April 2025) ⤴

-

Seamus Wolf (April 2025) ⤴

-

Seamus Wolf (April 2025) ⤴

-

check24.de (May 2025), krankenkassen.de (May 2025) ⤴

-

“95 the same” (June 2025), check24.de (May 2025) ⤴

-

Feather Insurance (May 2025), Uni Frankfurt (May 2025) ⤴