This guide helps you choose the best student health insurance. You need health insurance to apply for a student visa, and to study at a German university.

Use my health insurance picker to see your options.

Health insurance for a student visa

To apply for a student visa, you need two health insurances:10

- Incoming health insurance

Get expat health insurance. It covers you from the day you arrive in Germany to the day you start university.6 It’s cheap, but the coverage is limited. I recommend Feather, but there are many other options. If you already live in Germany, you don’t need incoming health insurance. - Long-term health insurance

Get public health insurance. It covers you after you start university. I recommend Barmer or TK. You can stay on expat health insurance until you graduate, but public health insurance is much better.

Get health insurance for your visa

After you get insured, you get two documents: a proof of incoming health insurance and a proof of long-term health insurance. Merge them together, and upload them on the Consulate Service Portal.12

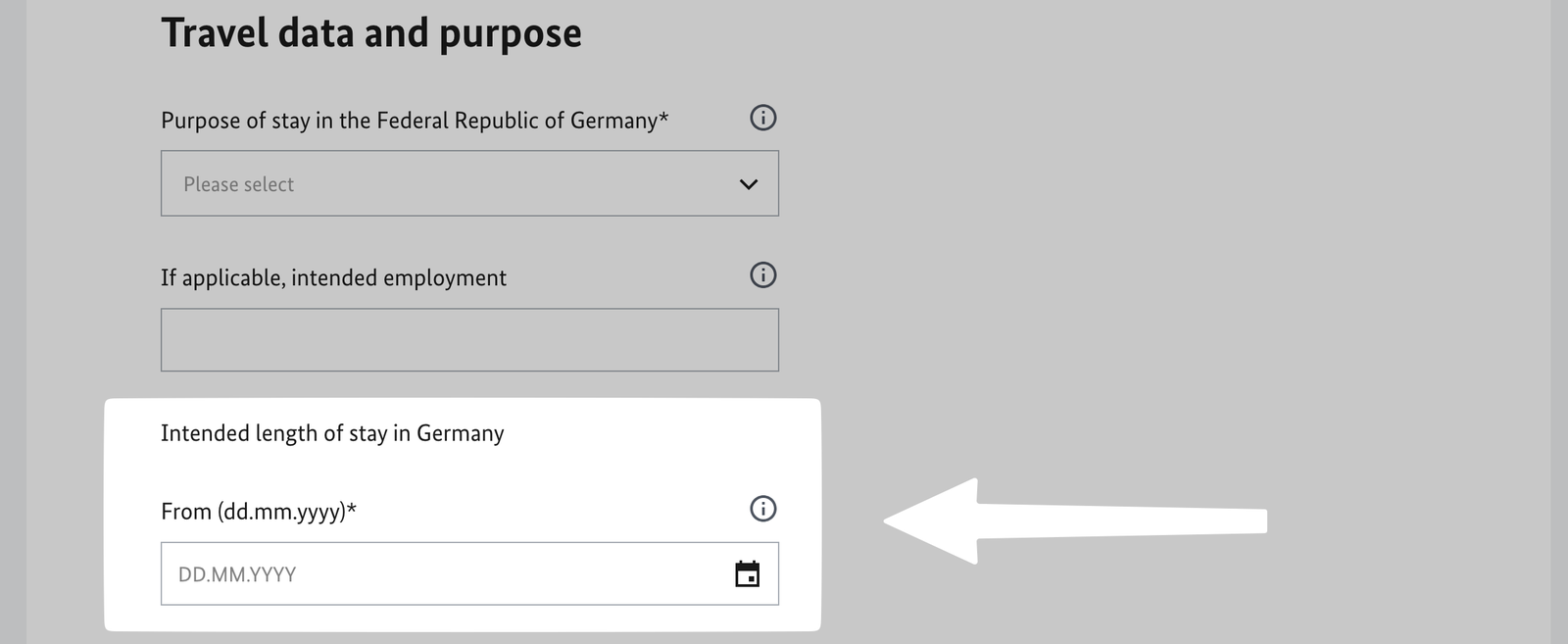

Your incoming health insurance must cover you from the day you arrive in Germany. It must match the arrival date in the Consular Services Portal.

Your public health insurer will tell your university that you are insured (the M10 Meldung). This is done digitally; you don’t need to do anything. It takes around 3 days.1

For students under 30 years old

If you are under 30 years old, there are 3 long-term health insurance options:

- Free health insurance

- Family health insurance

If your spouse has public health insurance, it covers you for free. If you are under 25 years old, your parents’ insurance can also cover you for free. - Insurance from your home country

Your EHIC covers you until you graduate or get a job. You might not need German health insurance.16

- Family health insurance

- Public health insurance

If you can’t get free health insurance, this is the best option.18 It costs around €150 per month. I recommend Barmer or TK. Switch to public health insurance maximum 3 months after you start university.9 - Expat health insurance

You can stay on expat health insurance until the end of your studies. It costs around €72 per month. This is the cheapest option, but the coverage is much worse. If you stay on expat health insurance, you are stuck with it until you graduate.3

For students over 30 years old

After 30 years old, your options change.

- Free health insurance

- Family health insurance

If your spouse has public health insurance, it covers you for free. Your parents’ health insurance can’t cover you, because you are too old. - Insurance from your home country

Your EHIC covers you until you graduate or get a job. You might not need German health insurance.16

- Family health insurance

- Public health insurance

It costs around €250 per month. It’s more expensive because you can’t get the student tariff.15 - Expat health insurance

This is the cheapest option, but the coverage is much worse. Ask my insurance expert if it makes sense for you. - Private health insurance

Usually, you can’t get private health insurance because your income is too low,20 but some insurers have cheap tariffs for students.19 If you choose private health insurance, you are stuck with it until you graduate.3 Ask my insurance expert if it makes sense for you.

If you just moved to Germany, you probably can’t get public health insurance. Expat health insurance might be your only option.13 You can get public health insurance if you had public health insurance in another EU country for 2 of the last 5 years.2

If you already live in Germany, you can keep your current public health insurance. If you currently have private or expat health insurance, it’s really hard to switch to public health insurance.

If you are over 30 years old, don’t choose health insurance yourself. Ask an expert to help you choose. It’s a free service.

For working students

Student jobs

If you work less than 20 hours per week, nothing changes.17 You pay the same price for public health insurance. You can still get free health insurance. You can also keep your expat health insurance. Your employer does not pay half of your health insurance.7

If you work more than 20 hours per week, you must switch to public health insurance and pay the the same price as other employees. You can’t get the student tariff, and you can’t get free health insurance.

Your student visa might not allow working more than 20 hours per week.14

Internships and apprenticeships

Health insurance for an internship

Self-employment

If you are self-employed during your studies, you can keep your student health insurance. The price does not change; you still pay the student tariff.8

If you work more than 20 hours per week, you are treated like other self-employed people, and your public health insurance costs a percentage of your income. If you are young and healthy, private or expat health insurance usually make more sense.5

If your earn more than €565 per month, you can’t get free health insurance.

For a language course visa

To apply for a language course visa, you only need expat health insurance. It must cover you from the day you arrive in Germany. I recommend Feather, but there are many other options.

You don’t need long-term health insurance.11 Usually, you can’t get public health insurance.

For a study preparation visa

To apply for a study preparation visa, you only need expat health insurance. It must cover you from the day you arrive in Germany. I recommend Feather, but there are many other options.

You don’t need long-term health insurance.11 You can switch to public health insurance when you start university.

After you graduate

When you start working, you must usually get public health insurance. If you make more than €77,400 per year, you can also choose private health insurance.

Health insurance for employees

If you are unemployed or self-employed, you might be stuck with your current private or expat health insurance until you find a job.4

Health insurance when unemployed

Health insurance for freelancers

How to get insured

There are many ways to get insured:

- Feather

They sell incoming and long-term health insurance. I work with them since 2018. They have great customer service, and their insurance is valid for a visa application. - Ask our expert

This is the best option if you are over 30 years old, if you have a special situation, or if you have questions. - Expatrio, Fintiba and Coracle sell packages that include a blocked account, incoming health insurance and long-term health insurance.

You can also buy health insurance directly from the insurer. The prices are the same. For expat health insurance, use this list of options. For public health insurance, I recommend Barmer or TK. They are the biggest insurers in Germany.

Sources and footnotes

-

Feather Insurance (May 2025), Uni Frankfurt (May 2025) ⤴

-

§ 9 Abs. 1 S. 1 SGB V, Seamus Wolf (June 2025) ⤴

-

Seamus Wolf (June 2025) ⤴

-

Seamus Wolf (June 2025), studierendenwerke.de (June 2025) ⤴

-

Seamus Wolf (April 2025), finanztip (February 2025), verbraucherzentrale.de (2024) ⤴

-

Techniker Krankenkasse (July 2025) ⤴

-

Feather Insurance (April 2025) ⤴

-

Facebook (March 2025), Reddit (August 2025), Reddit (August 2025) ⤴

-

uni-frankfurt.de (2025), Berlin.de (September 2025), Berlin.de (September 2025) ⤴

-

Feather Insurance (May 2025) ⤴

-

Feather Insurance (2023), Feather Insurance (May 2025), krankenkassen.de (May 2025) ⤴

-

Techniker Krankenkasse (January 2025), Techniker Krankenkasse (March 2025), meinpraktikum.de (March 2025) ⤴

-

finanztip.de (January 2025), Feather Insurance (May 2025) ⤴

-

krankenkassen.de (May 2025), krankenkassen.de (May 2025) ⤴

-

Feather Insurance (May 2025) ⤴