Degiro is an online broker with low fees. You can buy and sell stocks, and their fees are much lower than most German banks.

I use Degiro since 2018. My 2019 review was negative, but Degiro has improved a lot since then. In 2025, I prefer buying stocks and ETFs through my bank, because it’s cheaper and easier. I still hold a big part of my investments in Degiro.

Using Degiro

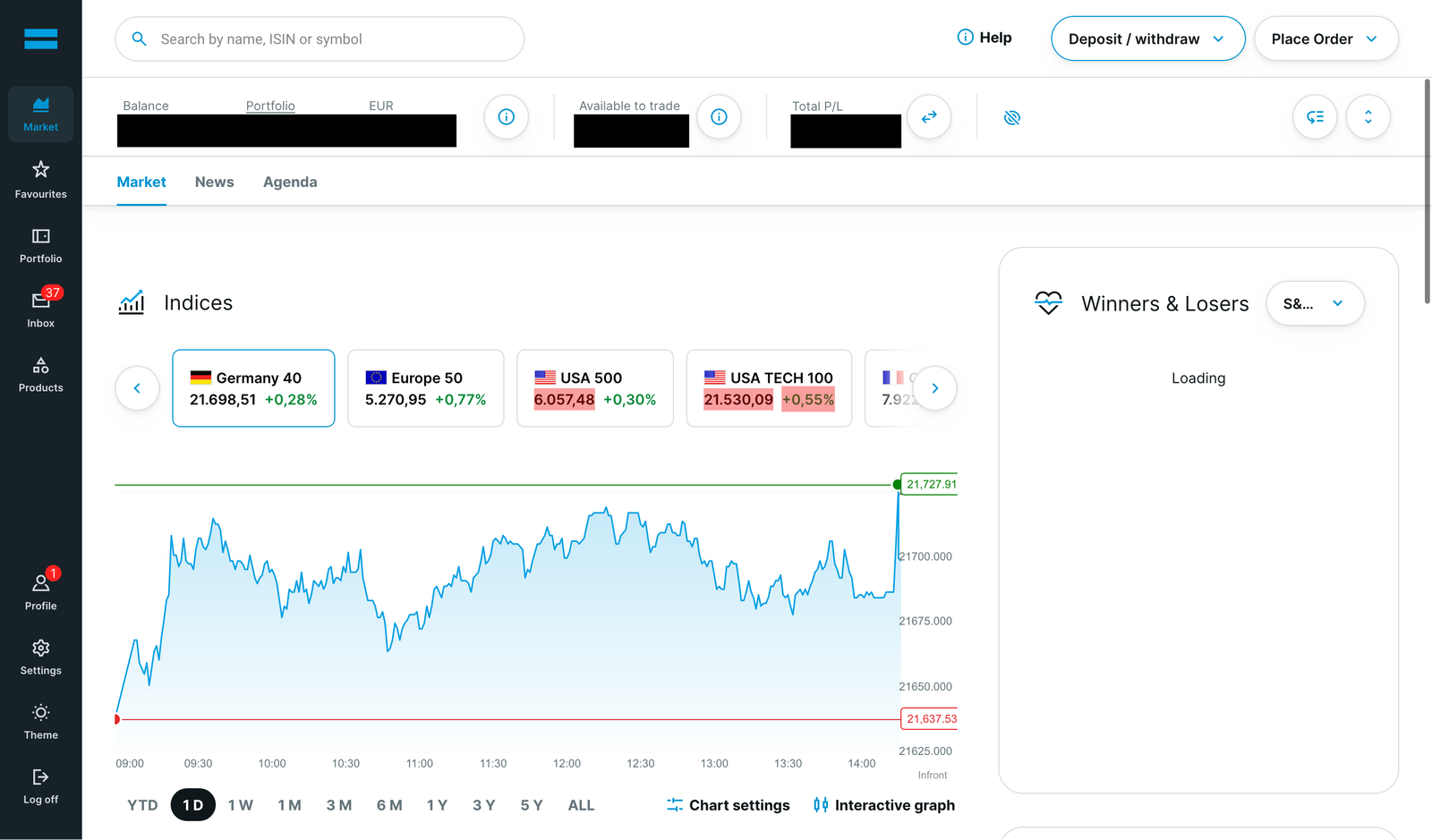

Since my last review, Degiro redesigned their web interface. It works really well on desktop and on mobile. I don’t use their app because the mobile website works really well.

When you make a transaction, you clearly see the expected fees before you confirm the transaction. The menus are a little confusing, but in general, the website is easy to use.

The user interface is a little crude. It was fine in 2018, but it’s not good enough for 2024. It’s not as clean and intuitive as modern banking apps. It’s also too limited for active traders. Interactive Brokers has a much better UI for active traders. Many online banks have better interfaces for casual investors.

No way to track performance

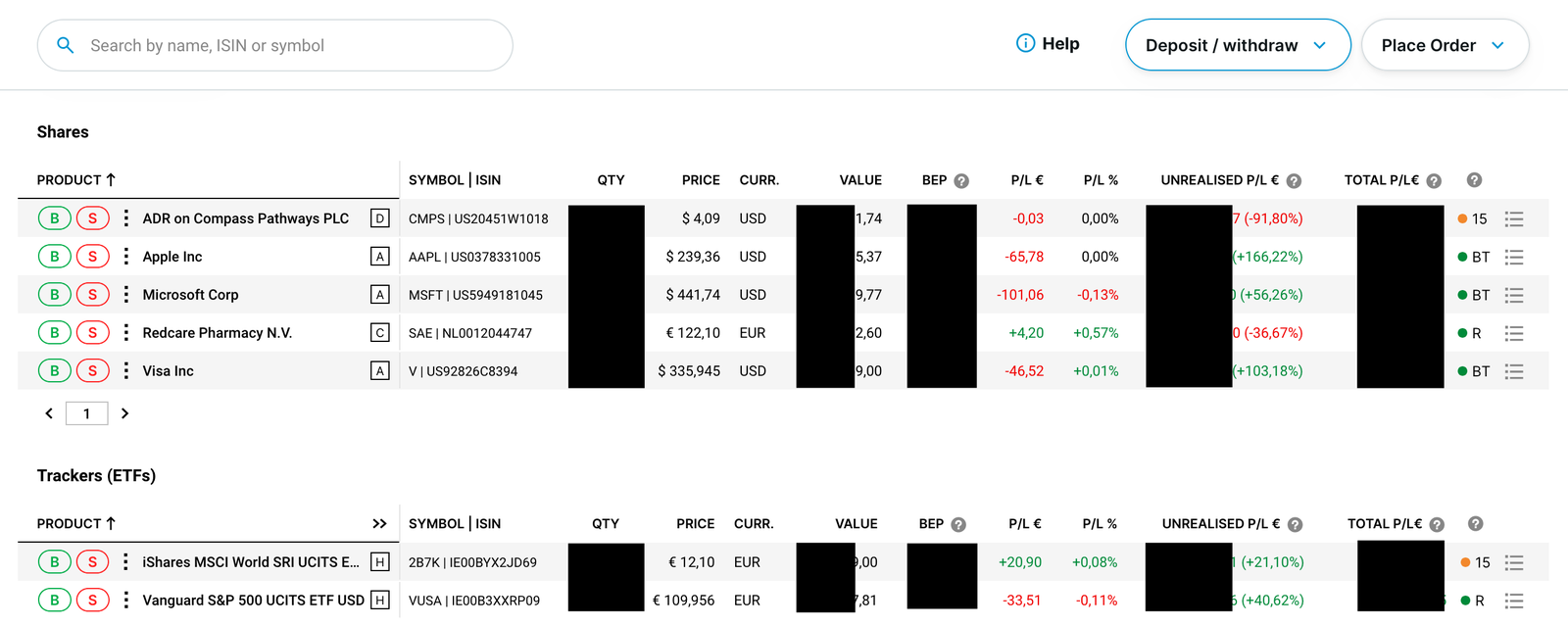

Degiro is missing one big feature: a graph of your profits over time. It’s impossible to know how much you made this week, this month or this year. You just see your daily gains/losses, and your total gains. I have my account since 2018, so total gains are useless.

This is also true for your stocks. You only see the purchase price and the current value. You can’t see how your investments grew this month.

This makes it really hard to track the performance of your portfolio. You must use separate software like Portfolio Performance. Many users complained about this.2 I’ve been waiting since 2018, but they never fixed this.

There is a Chrome extension that fixes this. Other people recommend Simple Portfolio for this. I should not need a separate app for this.

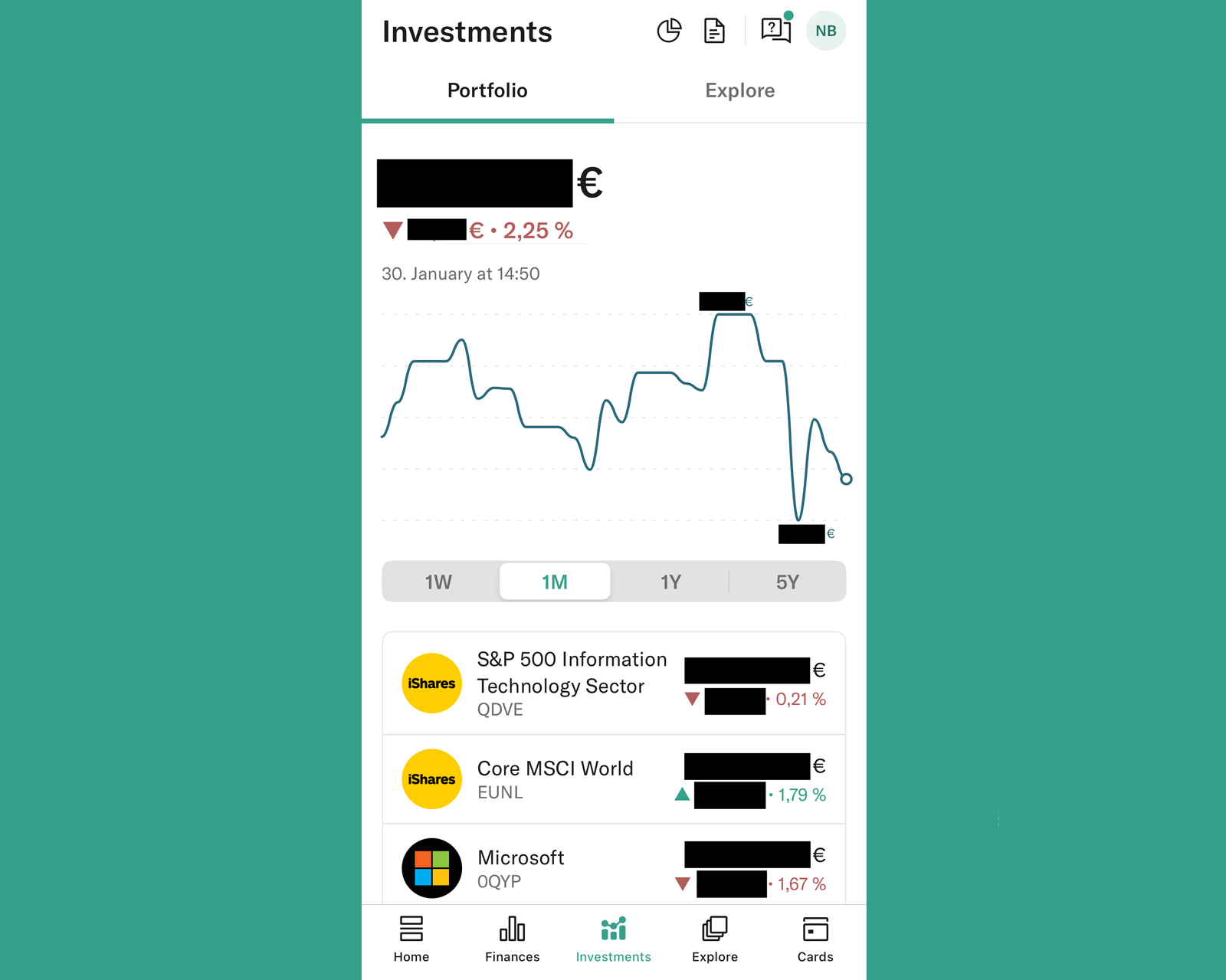

The N26 app does it so much better, and 100% in English. The first thing I see is a graph of my portfolio’s performance. I can see the daily, weekly, monthly and yearly performance. I don’t understand why Degiro can’t do this.

Mostly in English

Degiro is in English and German. A few years ago, it was only in German, and I found it very confusing.

The landing page and some important parts of the registration process are only in German. It’s better than before, but it needs a lot of improvement.

Deposits and withdrawals

Moving money between my German bank account and Degiro is easy. With SOFORT, it takes a minute. You can also use SEPA transfers and wait a little longer. I transferred tens of thousands of euros in and out of Degiro without any issues.

Reliability

A few years ago, the Degiro platform was not reliable. It went down a few times per month. That’s why my 2019 review was so negative. In 2025, I have no problems. I don’t check the website as often, but I have not noticed any downtime for years. Other people complain about frequent maintenance periods, but those happen outside of trading hours.

Fees

Degiro’s fees are low: around €2 per trade. Some German banks charge €10 to €20 per trade plus monthly fees. This is why I switched from Commerzbank to Degiro in 2018. I saved hundreds of euros in trading fees.

The fees used to be much lower. They raised their fees a lot, so it’s not as competitive as before.3 If you trade larger amounts, Interactive Brokers might be cheaper.4

My bank gives me a few free trades per month, so Degiro fees no longer make sense for me. I did not sell the stocks I bought with Degiro, but I only use the N26 app to buy new stocks and ETFs.

No US options

You can’t trade US options on Degiro. If you need this, use Interactive Brokers instead.

Summary

The good:

- It’s easy to open an account

- The fees are low

- It’s easy to use

- The platform is in English

The bad:

- It’s impossible to track portfolio performance over time

- You can’t buy US stock options5

- Most documents are only in German

- The fees are not as competitive as before

Degiro is fine, but in 2025, there are better options. Online banks like N26 make passive investing much easier. For serious traders, Interactive Brokers is much better. There is no good reason to choose Degiro anymore. It’s good, but the competition is better.

Degiro alternatives

These online banks let you trade stocks:

- Interactive Brokers

It’s often recommended as an alternative.1 It has low fees and a better user interface. It lets you trade US stock options. - N26

I now buy stocks and ETFs through my N26 account. I find it much easier. In general, I like N26 a lot. See my review of N26. - DKB

You need German citizenship or permanent residence to open an account. - 1822direkt

- Comdirect

- eToro

Most traditional banks also let you trade stocks. Their transaction fees are often much higher, and their user interface is usually bad.

However! I have an N26 account since 2016, and since 2024, I buy all my stocks and ETFs through their app. I find it much easier to use. The fees are even lower, the interface is intuitive, and you don’t need to transfer money between your bank and Degiro all the time. It removes a lot of friction, and it works better for me.