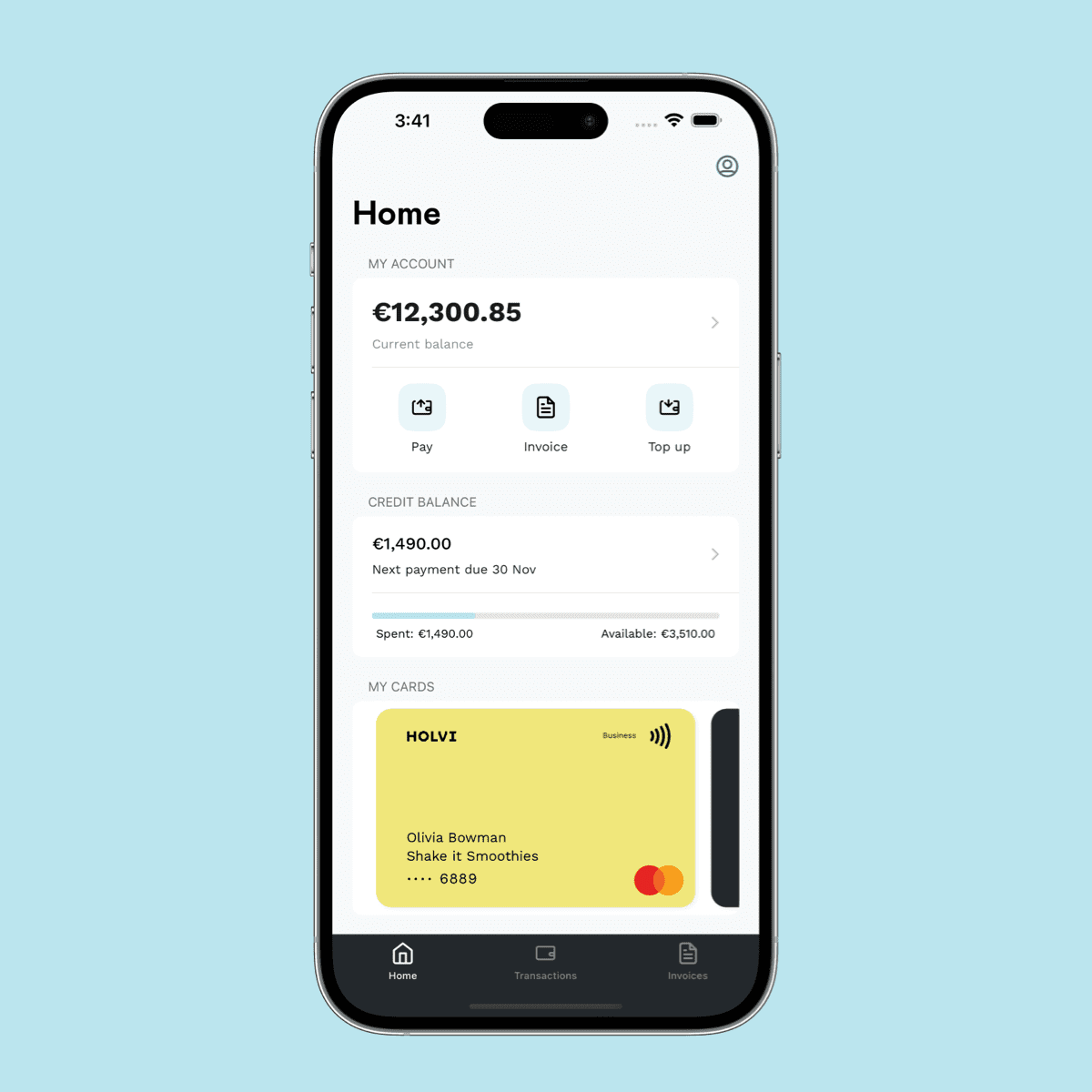

Open your business account online in minutes

Get multiple IBANs for your business. With the Holvi business account, you can separate business from personal payments and save time on accounting.

- Up to 10 German IBANs

- Debit, credit and virtual cards

- VAT calculator

- Save receipts

- 100% online

0 €

Free for 30 days

Corporate Account

Your own German IBAN

It all starts here. Business banking, invoicing, expense management and tax prep – master your business finances.

- A business account with German IBAN & BIC

- Instant transfers

- Expense management and receipt storage

- Add users and manage their access rights

- Invite your accountant

- Lexware Office connection for easy bookkeeping

- Download reports & account statements

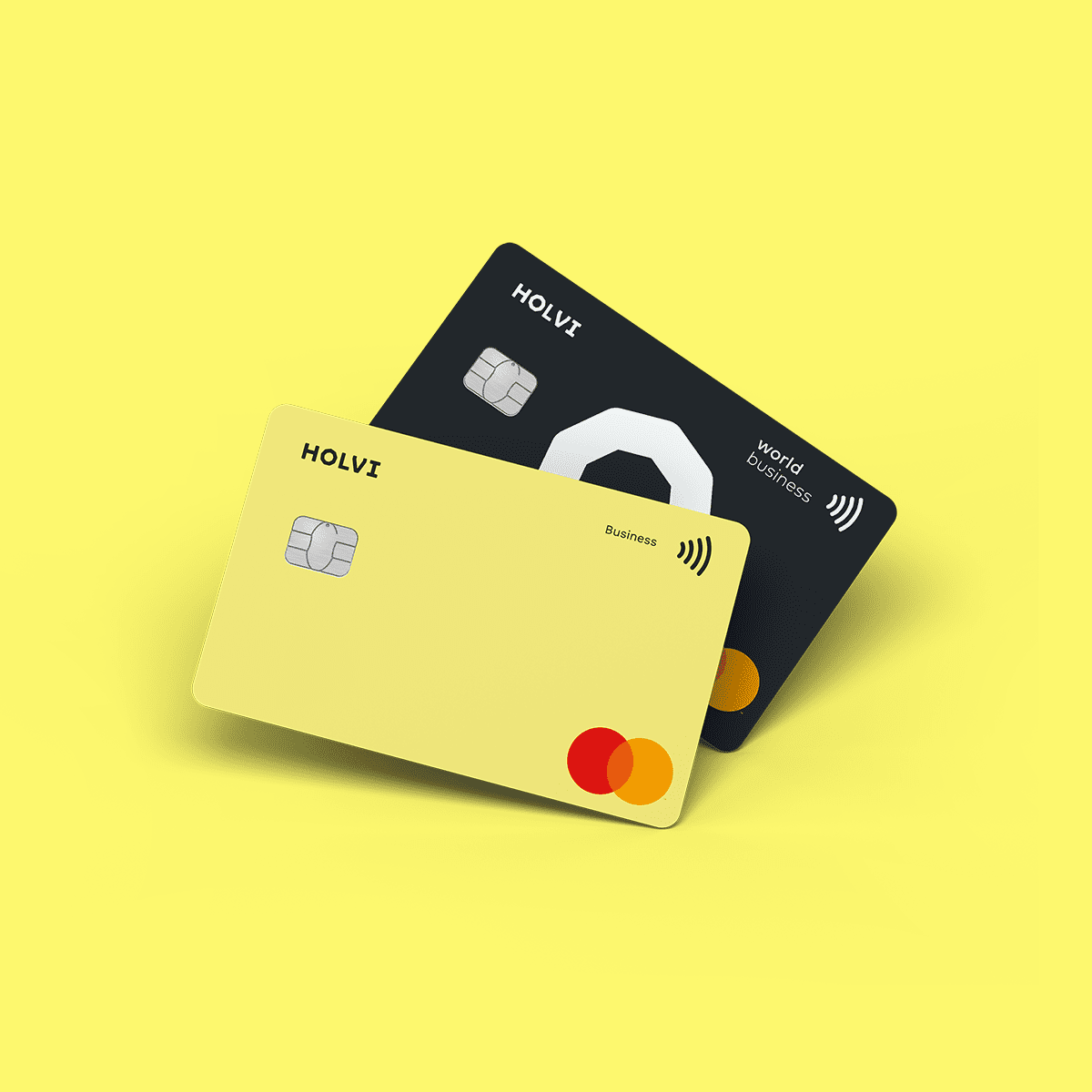

Debit, credit & virtual cards

Smart payment cards

Create virtual cards in seconds and pay in-store using Apple Pay or Google Pay™️. Instant access, control and security at your fingertips.

Plus, you can order a physical Holvi Debit Card or Holvi Credit Card for even more financial freedom.

- Safe online payments with Mastercard® Identity Check™ 3D Secure & 2FA

- Real-time notifications keep you up to date

- Lock and unlock your cards any time

- View your PIN in your Holvi-App

- Order team cards

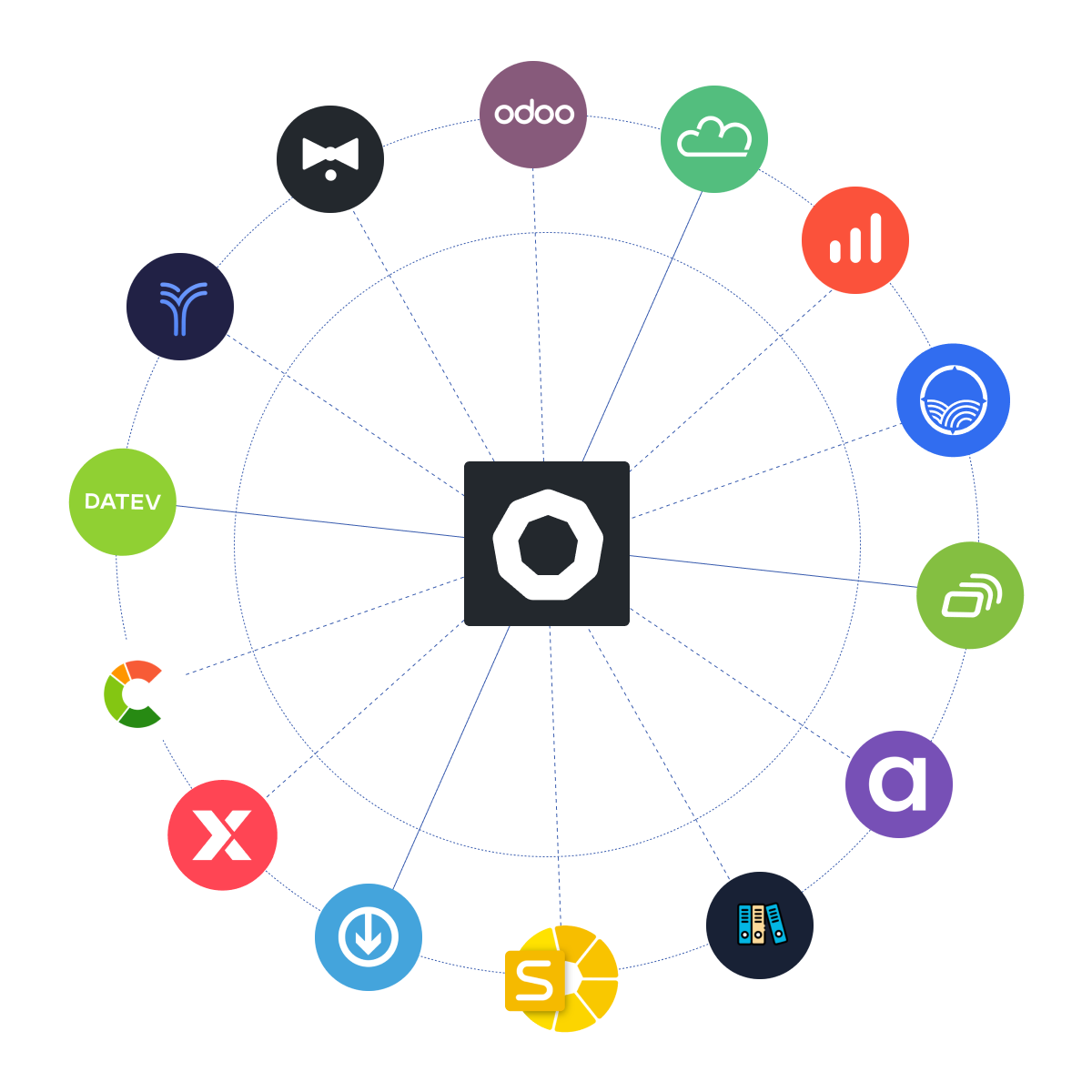

Save time on accounting

Holvi works with the leading accounting tools. Easily connect your account with your preferred accounting software or your tax advisor.

- DATEV Connection: Synchronise transactions with your tax advisor or book yourself with DATEV Unternehmen Online.

- Lexware Office Connection: Connect Lexware Office (formerly lexoffice) with Holvi and handle your accounting and annual financial statements yourself.

- Compatible with leading tools: sevDesk, BuchhaltungsButler, and many more.

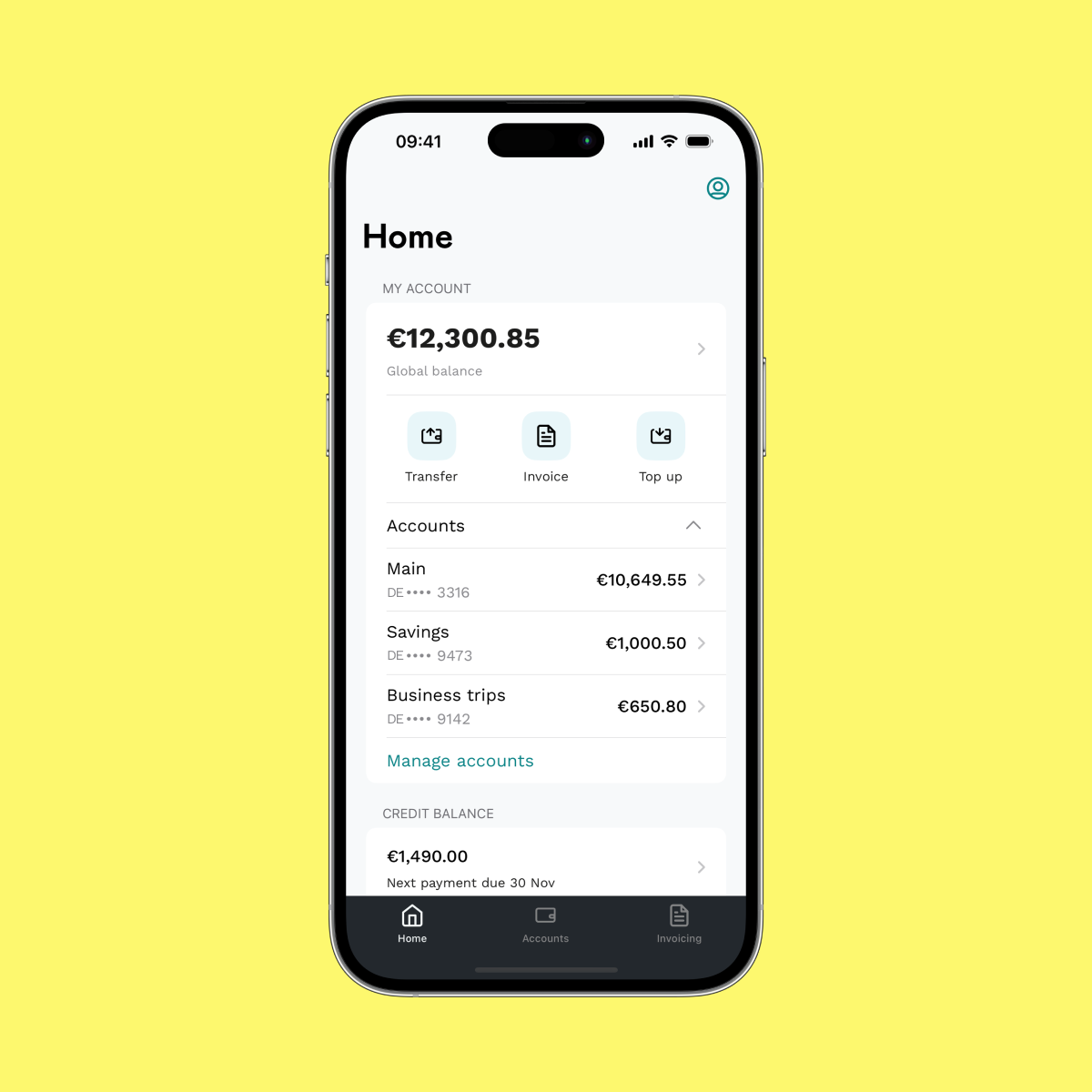

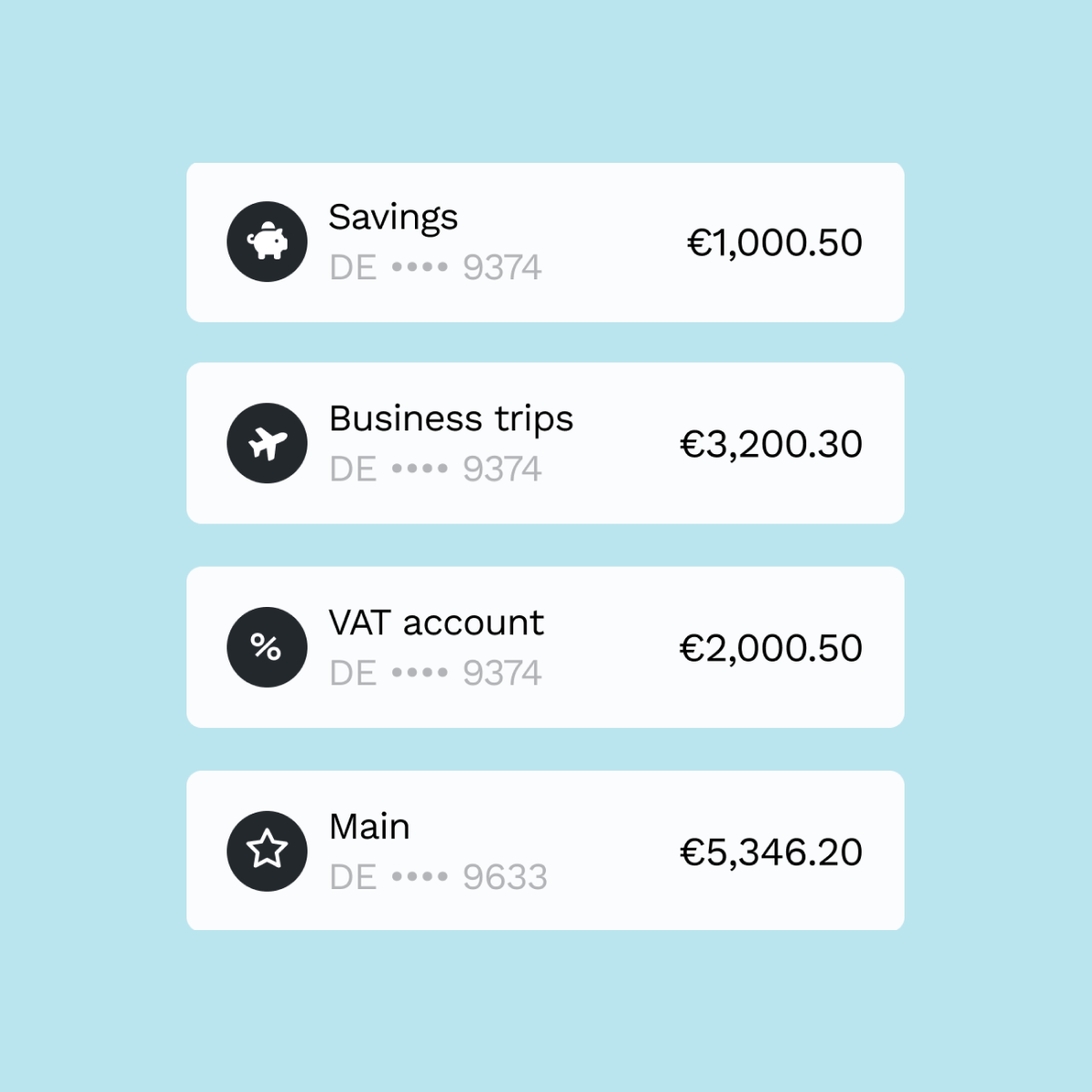

New: Additional accounts

Your finances, organised

Create your own IBAN accounts for different projects, sources of income or VAT payments. With the help of additional accounts, you keep your finances even better under control.

Smart account – see your VAT in real time

Holvi’s VAT calculator shows you how much you have to save for tax time. Manage your cash flow and stay in the know.

Make use of multiple accounts

Create your own IBANs for different projects, types of income or tax reserves. You can also create payment cards for your multiple accounts.

Account security is our top priority

Biometric login

Secure login and online card payments with 2FA and Mastercard® Identity Check™.

Multi-Factor Authentication

Verify transactions using a combination of passwords, codes, and biometrics (e.g. fingerprint).

Bank-level security

As a licenced payment institution, we follow the same strict security rules as a bank.

Happy Holvi customers

Try Holvi Pro – free for 30 days

Check out the Holvi Pro business account with DATEV connection for 30 days, free of charge!

1. Fill in your personal data

2. Verify your identity

(via video call or electronic ID)

3. Fill in your company info

Invoice your clients

Create and send invoices easily from your business account. Get notified the moment you get paid.

Automate your bookkeeping

Connect to DATEV and Lexware Office. This is hassle-free bookkeeping – plus you save time and money.

Still curious?

Find answers to your questions in our Help Centre, or contact Holvi Support.

About us

We’ve lived and learned the entrepreneur life. Now we’re here to simplify yours.

How it works

Holvi has you covered – from a business account, to online invoicing, to online bookkeeping.

FAQs – Holvi business account

To open a Holvi business account, you need:

- Name and address

- Name, industry and location of your company

- E-mail address and phone number

- A valid ID

- A Smartphone

- An estimation of your annual turnover

- Information about the ownership of your company

- In the case of GmbHs & UGs, additional documents are needed

Here you can find Holvi’s step-by-step guide to verification

You can open your Holvi business account online in a matter of minutes. From our side, the verification and activation process of your account usually takes a couple of days. After that, your account is ready to go!

You can open a Holvi business account for these types of companies in Germany:

- Gewerbe – sole proprietorship (not registered)

- e.K. (eingetragene Kauffrau/eingetragener Kaufmann) – registered merchant

- Freiberufler – Freelancer

- GbR (Gesellschaft bürgerlichen Rechts)

- eGbR – eingetragene Gesellschaft bürgerlichen Rechts

- OHG – Offene Handelsgesellschaft

- KG – Kommanditgesellschaft

- GmbH – limited liability company

- GmbH i.G. – GmbH in formation

- UG – Unternehmergesellschaft (limited liability)

- UG i.G. – Unternehmergesellschaft (limited liability) in formation

You can receive money via SEPA transfer in euros. You can also send invoices and e-invoices from Holvi, and collect payments that way. Connect your account to payment terminals like SumUp to accept card payments.

All pricing plans include the following:

- A free virtual card

- A Holvi Debit Card

You can apply for the Holvi Business Credit Card for even more financial freedom. This lets you cover short-term cash flow gaps and invest in your business.

Read more about our Holvi Payment Cards: Business Mastercard

Holvi does not offer overdrafts. This means you can not spend more than you have. You’ll need sufficient funds to make a purchase or send a payment. Check your balance quickly in the Holvi app, and scan your finance forecast in the Holvi dashboard.

For more financial freedom you can apply for the Holvi Business Credit Card. A credit card with a credit line of up to €5,000 to spend as you like.

Yes. We offer founders accounts for the German company forms GmbH and UG. You can pay your share capital into this account before the commercial register extract is available. All other types of companies must be fully verified when opening an account.