When you start a business in Germany, you must fill the Fragebogen zur steuerlichen Erfassung. This is how you register your business with the Finanzamt. All businesses and self-employed people must do this.

When you fill this form, you get:

- a tax number (Steuernummer)

- a VAT number (Umsatzsteuernummer), if you charge VAT

- an entry in the trade register (Handelsregister), if you need one

Since 2021, there is no paper form. You must fill this form online.1

Different ways register your business

There are 3 ways to register your business with the Finanzamt:

- Online with ELSTER (in German)

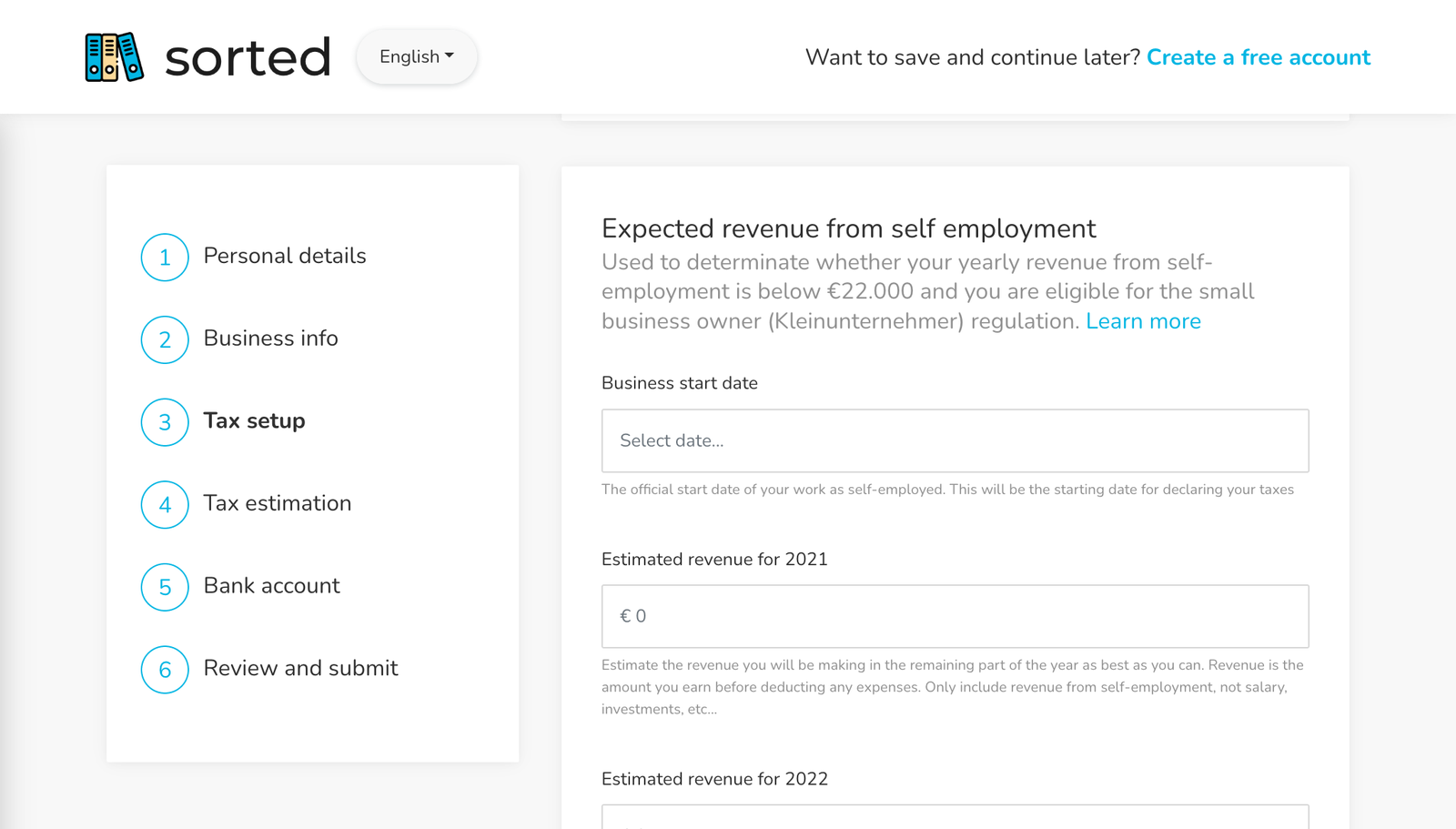

This is the official way. Create an ELSTER account and fill the Fragebogen zur steuerlichen Erfassung. This is what I describe in this guide. It’s a bit complicated, and it’s all in German, but you can do it yourself. It’s free. - Online with Sorted (in English)

Sorted built a tool to register your business. It’s faster and easier than the official form, and it’s in English. I tried it myself, and I think it’s great. It’s free. - With a tax advisor

Your tax advisor (Steuerberater) can register your business for you. My tax advisor did it in 5 minutes. This is the safest and easiest way, but it’s hard to find a tax advisor. Use my list of English-speaking tax advisors.

Before you start

Can you be self-employed?

You might need a residence permit to live in Germany. Your current residence permit might not allow you to be self-employed. It usually takes a few months to change your residence permit.

Do you need a residence permit? ➞

If you apply for the German freelance visa, you can register your business after you apply for the visa. When you renew your freelance visa, your business should already be registered.

Are you a Freiberufler or a Gewerbe?

If you register a Gewerbe, you must get a trade licence (Gewerbeschein) before you continue. This takes a bit more time. If you are a Freiberufler, you don’t need one.

Difference between Freiberufler and Gewerbe ➞

Register your address and get a tax ID

You need a registered address and a tax ID to create an ELSTER account and register your business. When you create the ELSTER account, they ask for your tax ID, and they send an account activation code to your registered address.

If you have a tax ID, but you don’t have a registered address, you can still register your business with a tax advisor. You can ask the Finanzamt to send letters to your tax advisor. This is what I do. My tax advisor takes care of everything.

How to register your address in Berlin ➞

Open a bank account

You need a bank account that supports SEPA transfers. This is how you pay your taxes. You a bank account before you fill this form.

How to open a business bank account ➞

Create an ELSTER account

You need an ELSTER account to register your business. Later, you can use your ELSTER account to file your taxes and submit VAT returns online.15 The ELSTER website is only in German. It takes a few days to create an account.

If you don’t want to create an ELSTER account, you can use Sorted’s business registration tool.

How to create an ELSTER account ➞

Get a Gewerbeschein

If you register a Gewerbe, you must get a trade licence (Gewerbeschein). This is how you register for the business tax (Gewerbesteuer). In Berlin, you can apply for a Gewerbeschein online or at the Ordnungsamt. You must do this before you register your business with the Finanzamt.

If you register as a Freiberufler, you don’t need a Gewerbeschein.16

Related guides:

- How to get a Gewerbeschein in Berlin

- How to find your tax ID

- What is the trade tax (Gewerbesteuer)?

- Freiberufler or Gewerbe: what’s the difference?

Understand the Value Added Tax (Umsatzsteuer)

This form is easier to fill if you understand how the Value Added Tax (VAT) works.

VAT number: To sell goods and services in the European Union, you need a VAT number. You must fill the Fragebogen zur steuerlichen Erfassung and wait 4 to 6 weeks.2 You should request a VAT number even if you don’t need it. It could be useful later.18 You can also request a VAT number later.

Charging VAT: If you are a Kleinunternehmer, you can choose to not charge VAT.3 If you don’t charge VAT, you can’t get VAT refunds for business expenses.4 If you decide to charge VAT, you can’t change your decision for the next 5 years.5 This guide explains when it makes sense to charge VAT.

How being a Kleinunternehmer works ➞

Understand the difference between revenue and profit

Revenue (Umsatz) or income is how much money you get, even if you don’t keep all of it. Some of that money goes to business expenses. Profit (Gewinn) is how much money you keep after expenses.

How to register your business with ELSTER

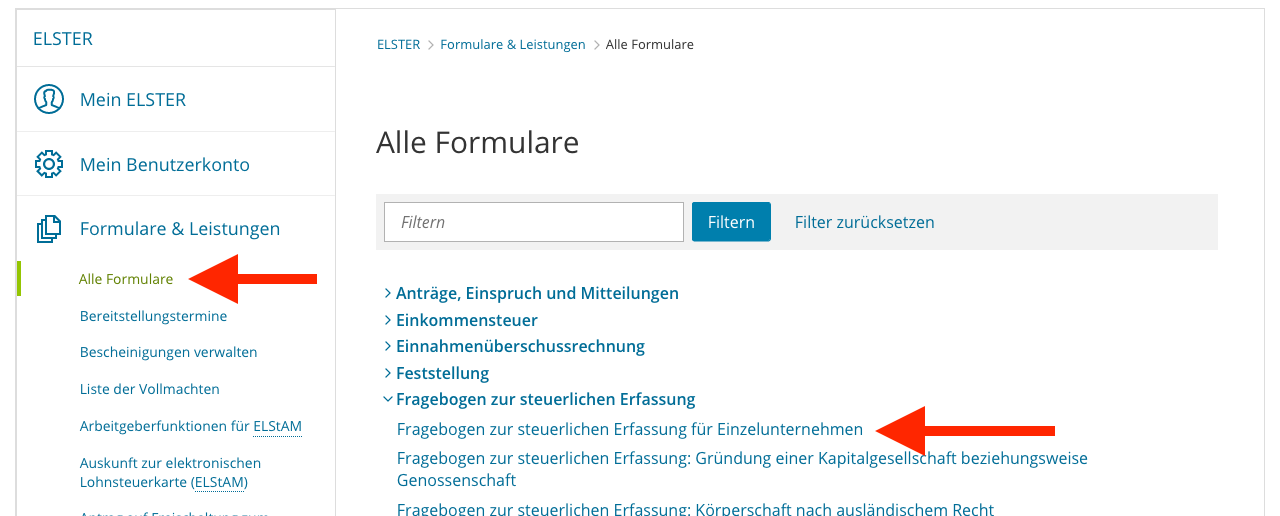

To register your business, you must fill the Fragebogen zur steuerlichen Erfassung. This was a paper form, but now it’s an online form on ELSTER. The online form is much easier to fill.

To find the form, go on ELSTER, and in the sidebar, under Formulare & Leistungen, click Alle Formulare and find the Fragebogen zur steuerlichen Erfassung für Einzelunternehmen.

Section 1: Angaben zur Person

In this section, you share information about you.

Steuerpflichtige(r) – Taxable person

- Anrede – Salutation

- Titel – Title

For example, “Dr.” - Name – Last name

- Gegebenenfalls Geburtsname – Name at birth, if applicable

- Vorname – First name

- Namensvorsatz – Name prefix

- Namenszusatz – Name suffix

For example, “der Ältere” or “Junior”. More examples here. - Ausgeübter Beruf – Practised profession

Your current profession. For example, “Zahnarzt” (dentist). You must write it in German. Use this list of professions to find the correct translation. - Geburtsdatum – Birth date

- Religion

- Identifikationsnummer – Tax ID

- Umsatzsteuer-Identifikationsnummer – VAT number

If you register a new business, you don’t have this number yet. You can leave this field empty. - Vergabedatum – Date of issuance

The date when you received your VAT number

Familienstand – Family situation

- Stand der Ehe / eingetragenen Lebenspartnerschaft – Status of marriage / registered partnership

- seit dem – Since…

The date when you got married, if applicable.

Adresse – Address

- Adresse im Inland – Address in Germany

Write the address where you live, not the address of your business.- Straße, Hausnummer, Hausnummerzusatz – Street, house number, extra house number information

The Hausnummerzusatz gives more information about the door number. For example, the floor number, the building number, the apartment number or the room number. - Adressergänzung – Address extension

For example, “bei [your name]” if your name is not on the mailbox.6 - Postleitzahl, Wohnort – Post code, locality

Your post code and locality. For example, “10115” and “Berlin”.

- Straße, Hausnummer, Hausnummerzusatz – Street, house number, extra house number information

- Adresse im Ausland – Address abroad

If you have an address outside of Germany, write it here. This is optional.- Straße, Hausnummer, Hausnummerzusatz – Street, house number, extra house number information

- Adressergänzung – Address extension

- Postleitzahl, Wohnort – Post code, locality

Your post code and locality abroad. For example, “10118” and “New York”. - Staat – Country

- Postfach – Post office box

If you have a P.O. box, write it here. This is optional.- Postfach – Post office box

For example, “3 22 63” - Postleitzahl, Ort – Post code, locality

For example, “10115” and “Berlin”.

- Postfach – Post office box

Telefon – Personal telephone

You can click “Weitere Daten hinzufugen” to add more phone numbers.

- Vorwahl international – International call prefix

If you live in Germany, it’s “+49” or “0049”. For other countries, use this list. - Vorwahl national – Local call prefix

If you live in Germany, it’s the first 2 or 3 digits of your local number. For example, “30” or “1522”. How to write German phone numbers. - Rufnummer – Phone number

The rest of your phone number.

E-Mail – Email

- E-Mail-Adresse – Email address

Your personal email address. Usually, the Finanzamt sends you letters, not emails.

Internet

- Internetadresse – Website URL

Section 2: Ehegatte / Ehegattin / eingetragene(r) Lebenspartner(in)

In this section, you share information about your spouse.

- Anrede – Salutation

- Titel – Title

For example, “Dr.” - Name – Last name

- Gegebenenfalls Geburtsname – Name at birth, if applicable

- Vorname – First name

- Namensvorsatz – Name prefix

- Namenszusatz – Name suffix

For example, “der Ältere” or “Junior”. More examples here. - Ausgeübter Beruf – Practised profession

Your spouse’s current profession. For example, “Zahnarzt” (dentist). You must write it in German. Use this list of professions to find the correct translation. - Geburtsdatum – Birth date

- Religion

- Identifikationsnummer – Tax ID

Adresse – Address of your spouse

Only fill this section if it’s different from your address.

- Adresse im Inland – Address in Germany

Write the address where your spouse lives. - Adresse im Ausland – Address abroad

If your spouse has an address outside of Germany, write it here. This is optional. - Postfach – Post office box

If your spouse has a P.O. box, write it here. This is optional.

Section 4: Steuerliche Beratung

In this section, you share information about your tax advisor, if you have one. If you don’t have a tax advisor, skip this section.

Natürliche Person – Natural person

Information about your tax advisor.

Adresse – Address

The address of your tax advisor.

Telefon – Telephone

The phone number of your tax advisor.

E-Mail – Email

The email address of your tax advisor.

Vollmacht – Power of attorney

- Die Anzeige der Empfangsvollmacht erfolgt über die Vollmachtdatenbank

Ask your tax advisor about this option.

Section 5: Empfangsbevollmächtige(r) für alle Steuerarten

The Finanzamt can talk to your tax advisor directly, instead of talking to you. This allows your tax advisor to take care of everything for you. It’s much easier that way.

- Steuerliche Beratung mit Empfangsvollmacht

Tick this box if you want the Finanzamt to talk to tax advisor (from section 4) instead of you. - Die Anzeige der Empfangsvollmacht erfolgt über die Vollmachtdatenbank

Ask your tax advisor about this option.

Natürliche Person / Adresse / Telefon / E-Mail If you want another person to talk to the Finanzamt for you, but not the tax advisor from section 4, write their information here.

Nicht natürliche person / Adresse / Telefon / E-Mail

If you want another business to talk to the Finanzamt for you, but not the tax advisor from section 4, write their information here.

Section 6: Bisherige persönliche Verhältnisse

If you moved to a different address in the last 12 months, you must enter your old address here.

Bisherige Adresse falls Sie innerhalb der letzten 12 Monate zugezogen sind – Previous address if you moved in the last 12 months

- Innerhalb der letzten 12 Monate zugezogen am – The date of your last address change.

Frühere Adresse – Previous address

Enter your previous home address.

Falls Sie in den letzten drei Jahren für Zwecke der Einkommensteuer steuerlich erfasst waren

If you paid income tax in Germany in the last three years, select the German state where you lived. If you had a job or a business in Germany, you must fill this section.

- Steuernummer – tax number

If you had a Steuernummer, enter it here. If this is your first business, you don’t have a Steuernummer yet.

Gegebenfalls hiervon abweichende Angaben Ihres Ehegatten … If your spouse paid income tax in Germany in the last three years, and your spouse had a different Finanzamt or Steuernummer, you must fill this section.

Section 7: Angaben zum Unternehmen

In this section, you share information about the business you register.

- Art der Tätigkeit – Type of occupation

A description of what you do as a freelancer or what your business does. You must write it in German, and you must be as specific as possible. If necessary, find a translator to help you. The Finanzamt will use this description to decide if you are a tradesperson (Gewerbe) or a freelancer (Freiberufler),7 so this is very important.

Official examples for this field:8- Handel mit Hilfsmitteln zum Schweißen oder Löten – Store that sells tools for soldering and metal welding

- Bäckerei (Handel mit Bäckereierzeugnissen – Brötchen, Brot, Backwaren) – Bakery (commerce with baked goods: bread, rolls, pastries)

- Arzt – Internist – Doctor, internist

- Bezeichnung des Unternehmens – Name of the business

This is the name of your business. For example, “All About Berlin”, or “John Smith, painter”. - Beginn der Tätigkeit – Start of the occupation

The date when you officially started working on your business, including opening bank accounts, reserving domain names, contracting other people etc. If you already started, you can use a date in the past.

Adresse des Unternehmens – Address of the business

The address of your business.

Telefon – Telephone

The phone number of your business.

E-Mail – Email

The email address of your business.

Section 8: Abweichender Ort der Geschäftsleitung

If your executive board is at a different address, you must put the information in this section.

Section 9: Betriebstätten

If you have multiple business locations, add them here.

Section 10: Handelsregistereintrag

Some businesses must be listed in the trade register (Handelsregister).17 If it’s not required for your business, don’t do it. A trade register entry requires a lot of extra work.

Who needs a Handelsregister entry? ➞

- Eine Eintragung ist beabsichtigt – Registration is intended

Select “Ja” if you want an entry in the trade register. If you don’t need one, you probably should not select “Ja”. - Eine Eintragung ist erfolgt – Registration is already done

Choose “Ja” if you already have an entry in the trade register. If this is a new business, choose “Nein”. - Der Handelsregistereintrag besteht seit – The trade register entry exists since…

If you already have an entry in the trade register, enter the date of registration. If this is a new business, leave this field empty. - Antrag beim Handelsregister wurde gestellt – A trade registration application was already made

If you already applied for a trade register entry, but you have not received it, choose “Ja”. Otherwise, choose “Nein”. - Antrag wurde gestellt am – Application was made on…

If you already applied for a trade register entry, but you have not received it, enter the date of your application. - Ort des zuständigen Registergerichts – Location of the registry court

If you applied for a trade register entry, or if you already have a trade register entry, enter the location of the Registergericht where you have an entry. - Handelsregister Bezeichnung – Label of the trade register

If you have a trade register entry, select the first letters of your trade register number. - Handelsregister Nummer – Trade register number

If you have a trade register entry, enter the rest of your trade register number.

Section 11: Gründungsform

In this section, you choose the type of company you are forming.

- Gründungsart – Type of formation

Choose “Neugründung”. - Gründungsdatum – Formation date

The start date of your business

Vorherige/r Inhaber/in

Information about the previous business owner. You can leave this section empty because you are registering a new business.

Vorheriges Unternehmen

Information about the previous business form. You can leave this section empty because you are registering a new business.

Section 12: Bisherige betriebliche Verhältnisse

- Ist in den letzten fünf Jahren schon ein Gewerbe …

Choose “Ja” if:- You have been a freelancer (Freiberufler) in Germany in the last 5 years

- …or you have owned a business (Gewerbe) in Germany in the last 5 years

- …or you have owned an agricultural or silvicultural operation in Germany in the last 5 years

- …or you have owned more than 1% of a corporation (Kapitalgesellschaft)

- Art der Tätigkeit/Beteiligung – Type of operation/involvement

If you chose “Ja” in the last field, enter a description of your previous activities. For example, you can write that you were the “owner of Jim’s

Widget Company”, or that you were a “freelance photographer”. Remember: you must fill this form in German. If you chose “Nein”, leave this field empty. - Ort – Location

If you chose “Ja”, enter the name of the city where it happened. If you chose “Nein”, leave this field empty. - Dauer: von – Duration from

If you chose “Ja”, enter the date when it started. If you chose “Nein”, leave this field empty. - Dauer: bis – Duration until

If you chose “Ja”, enter the date when it ended. If you chose “Nein”, leave this field empty. - Umsatzsteuer-Identifikationsnummer – VAT number

If you chose “Ja”, enter the date VAT number of that business. If you did not have one, leave this field empty. If you chose “Nein”, leave this field empty.

Steuernummer Vortätigkeit – Tax number of previous activity

If you chose “Ja”, enter the tax number of that previous operation.

Section 13: Angaben zur Festsetzung der Vorauszahlungen

In this section, you enter your expected profit for your first 2 years in business. You must enter the expected profit (not revenue7) from all your jobs, businesses and investments. This helps the Finanzamt calculate your tax prepayments.

There are 4 columns to fill:

- Your expected income during your first year in business.

- Your spouse’s expected income during your first year in business. If you are not married or in a civil union, leave this column empty.

- Your expected income during your second year in business.

- Your spouse’s expected income during your second year in business. If you are not married or in a civil union, leave this column empty.

Voraussichtliche Einkünfte aus – Expected income from…

- Land- und Forstwirtschaft – Agriculture and silviculture

- Gewerbebetrieb – Commercial operations

The profit from running your Gewerbe. - Selbständiger Arbeit – Freelance work

The profit from working as a Freiberufler. - Nichtselbständiger Arbeit – Employment

For example, your salary from a regular full time job or from a mini-job. - Kapitalvermögen – Investments

For example, investments in the stock market. - Vermietung und Verpachtung – Rental and leasing

For example, income from renting an apartment. - Sonstigen Einkünften – Special income

For example from a pension.

Voraussichtliche Höhe der – Expected amount of…

- Sonderausgaben – Special expenses

This is for expenses like tax write-offs, not regular business expenses like office supplies or advertising. If you are not sure, leave this row empty. - Steuerabzugsbeträge – Tax deduction amounts

Expected amount of income tax deductions. If you are not sure, leave this row empty.

Section 14: Angaben zur Gewinnermittlung

In this section, you choose how you report your income to the Finanzamt.

- Gewinnermittlungsart – Type of profit assessment

This is how you report your profit to the Finanzamt. Read this guide or this guide to compare single and double entry bookkeeping. If you are not sure, ask a tax advisor.- Gewinn- und Verlustrechnung – Profit and loss statement

Also known as double entry bookkeeping. In some cases, you are forced to use double entry bookkeeping.- If you will be registered in the Handelsregister, you must choose this option.3

- or if you register a Gewerbe, and you make more than 80,000€ per year in profit, you must choose this option.3

- or if you register a Gewerbe, and you make more than 800,000€ per year in revenue, you must choose this option.3

- Einnahmen-Überschuss-Rechnung – Income surplus calculation

Also known as single entry bookkeeping or cash-basis accounting. This is simpler than double entry bookkeeping.- If you register as a Freiberufler, you do not need to use double entry bookkeeping.3 Single entry bookkeeping can be easier for you.

- If you are a small business (Kleinunternehmer), you do not need to use double entry bookkeeping.3 Single entry bookkeeping can be easier for you.

- Betriebsvermögensvergleich – Comparison of business assets

- Gewinnermittlung nach Durchschnittssätzen

Report your profit based on average rates. This option is only for agricultural and silvicultural businesses. - Sonstige – Other

Report your profit with another method. This probably is not for you.

- Gewinn- und Verlustrechnung – Profit and loss statement

- Erläuterung der sonstigen Gewinnermittlungsart – Explanation for the special type of reporting

If you chose “Sonstige” in the last field, you can explain why in this field. If you chose something else, leave this field empty. - Liegt ein vom Kalenderjahr abweichendes Wirtschaftsjahr vor? – Do you use a different fiscal calendar?

If your business year starts on January 1 and ends on December 31, choose “Nein”. If your business uses a different fiscal calendar, choose “Ja”. You will probably choose “Nein”. - Beginn des vom Kalenderjahr abweichenden Wirtschaftsjahres – Start date of the fiscal calendar

If you chose “Ja” in the last field, enter the start date of your fiscal calendar. If you don’t use a different fiscal calendar, leave this field empty. You will probably leave this field empty.

Section 15: Freistellungsbescheinigung gemäß § 48b EStG (Bauabzugssteuer)

Check this box if you want to apply for tax deductions on construction work. If you have big construction or renovation expenses, ask a tax advisor about this section. If you don’t have construction or renovation expenses, do not check this box.

Section 16: Angaben zur Anmeldung und Abführung der Lohnsteuer

In this section, you list your employees. This affects how much payroll tax you will pay.7 If you don’t have employees, you can skip this section.

Zahl der Arbeitnehmer – Number of employees

- Zahl der Arbeitnehmer (einschließlich Aushilfskräfte) insgesamt – Total number of employees, including temporary workers

Write the total number of employees you are hiring, including temporary workers. If you do not have employees, leave this line empty. - davon Familienangehörige – …that are relatives

Write the number of employees that are members of your family. - davon geringfügig Beschäftigte – …that are marginally employed

Write the number of marginally employed workers (employees with minijobs).9

Beginn der Lohnzahlungen – Start of salary payments

The date when you will start paying your employees.

Voraussichtliche Lohnsteuer im Kalenderjahr – Expected payroll tax this calendar year

Use this website to calculate payroll tax you must pay. If you do not have employees, you do not need to pay payroll tax, so you can leave this line empty.

Lohnsteuerliche Betriebstätte – Payroll tax business location

This is the business location that pays the payroll tax. If you only have one business address, use that address.

Section 17: Angaben zur Anmeldung und Abführung der Umsatzsteuer

In this section, you register for VAT, and choose how to make VAT (Umsatzsteuer) payments. You must understand how VAT works in Germany.

Geschäftsveräußerung im Ganzen (§ 1 Absatz 1a UStG)

If you are not buying or selling another company, choose “Nein”. If you are not sure, ask a tax advisor about it.

Summe der Umsätze (geschätzt) – Total revenue (estimated)

Your estimated revenue is used decide how you will pay your taxes. It also decides if you can be a small business (Kleinunternehmer).

- im Jahr der Betriebseröffnung – in the first year of business

How much revenue you expect in your first year of business (your first calendar year, not your first 365 days). - im Folgejahr – in the second year of business

How much revenue you expect in your second year of business (your second calendar year, not your first 365 days).

Kleinunternehmer-Regelung

If you are a small business (Kleinunternehmer), you can charge VAT, but you don’t have to. You can only be a small business if your revenue is under 22,000€ in your first year of business and under 50,000€ in the following years.3 Freiberufler and Gewerbe can both be small businesses. – More information

- … In Rechnungen wird keine Umsatzsteuer gesondert ausgewiesen …

Check this box if you are a small business (Kleinunternehmer), and you don’t want to charge VAT (Umsatzsteuer) on your invoices. If you think your business will stay small, this can be better.10 – More information - … Es wird auf die Anwendung der Kleinunternehmer-Regelung verzichtet. …

Check this box if you are a small business (Kleinunternehmer), and you want to charge VAT (Umsatzsteuer) on your invoices. If you think your business will make over 50,000€ per year later, this can be better.10 – More information

Zahllast / Überschuss (geschätzt)

Enter how much VAT you will collect. This decides how you will make VAT payments to the Finanzamt.

Steuerbefreiung – Tax exemption

If you are a small business (Kleinunternehmer), and you don’t plan to charge VAT, skip this subsection.

- Es werden ganz oder teilweise steuerfreie Umsätze gemäß § 4 UStG ausgeführt – There will be tax-free revenue according to § 4 UStG.

Choose “Ja” if you want to apply for partial or total VAT exemptions according to § 4 UStG. Here is a list of activities that can have tax exemptions.11 If you are a freelancer or a small business, this probably does not apply to you. - nach § 4 Nummer – According to § 4 paragraph…

Write the number of the paragraph in § 4 UStG that qualifies you for a tax exemption. For example, “15a” (tax exemption for medical services). This list can help you. If you chose “Nein” in the previous field, leave this field empty. - Art des Umsatzes / der Tätigkeit – Type of revenue or activity

The activity for which you want a tax exemption. For example: “medizinische Dienste” (medical services).12 This list can help you. If you do not apply for a tax exemption, leave this field empty.

Steuersatz – Tax rate

If you are a small business (Kleinunternehmer), and you don’t plan to charge VAT, skip this subsection.

- Es werden Umsätze ausgeführt, die … dem ermäßigten Steuersatz gemäß § 12 Abs. 2 UStG unterliegen – Some revenue will have a reduced tax rate according to § 12 Abs. 2 UStG.

Choose “Ja” if you want to charge a lower VAT according to § 12 UStG. For some products and services, you can charge a 7% VAT instead of 19%. You must list these products separately on your invoices, and you must specify why the lower tax rate applies. - nach § 12 Absatz 2 Nummer … UStG – According to § 12 paragraph…

Write the number of the paragraph in § 12 UStG that qualifies you for a lower VAT. If you chose “Nein” in the previous field, leave this field empty. - Art des Umsatzes / der Tätigkeit – Type of revenue or activity

The activity for which you want to charge a lower VAT. If you do not plan to charge less VAT, leave this field empty.

Durchschnittssatzbesteuerung

This only applies to agricultural and silvicultural businesses. If it does not apply to you, skip this subsection.

- Es werden … Umsätze ausgeführt, die der Durchschnittssatzbesteuerung gemäß § 24 UStG unterliegen – Some revenue will be taxed according to § 24 UStG.

Choose “Ja” if you want to charge taxes according to § 24 UStG. This only applies to agricultural and silvicultural businesses. If it does not apply to you, choose “Nein”.

Soll- / Istversteuerung der Entgelte

You can choose to calculate VAT payments based on the revenue you should have (Sollversteuerung), or on your real revenue (Istversteuerung).

- Ich berechne die Umsatzsteuer nach – I measure the VAT according to…

- Sollversteuerung

You make VAT payments based on the amounts you have invoiced, even if you haven’t received the money yet. - Istversteuerung

Check this box if you want to charge VAT based on the amount you actually have collected. You only make VAT payments once you receive money from your customers. If you are a freelancer or a small business, this is the

best option for you.11

- Sollversteuerung

- Ich beantrage die Istversteuerung, weil der … Gesamtumsatz für das Gründungsjahr den in § 20 Satz 1 Nummer 1 UStG genannten Betrag voraussichtlich nicht übersteigen wird.

Check this box if you chose Istversteuerung, and you expect to make less than 800,000€ in revenue during your first year.13 - Ich beantrage die Istversteuerung, weil ich von der Verpflichtung, Bücher zu führen und auf Grund jährlicher Bestandsaufnahmen regelmäßig Abschlüsse zu machen, nach § 148 AO befreit bin

Check this box if you chose Istversteuerung, and you don’t want to use double entry bookkeeping because of §148 AO. In other words, check this box if you think double entry bookkeeping would be too hard for your business. - Ich beantrage die Istversteuerung, weil ich Umsätze ausführe, für die ich als Angehöriger eines freien Berufs im Sinne von § 18 Abs. 1 Nr. 1 EStG weder buchführungspflichtig bin noch freiwillig Bücher führe

Check this box if you chose Istversteuerung, and you don’t want to use double entry bookkeeping because you are a Freiberufler.

Umsatzsteuer-Identifikationsnummer

Check this box if you want to get a VAT number. You should always ask for a VAT number, even if you don’t need it now.18 If you need it later, you will already have it.

Steuerschuldnerschaft des Leistungsempfängers bei Bau- und/oder Gebäudereinigungsleistungen

This subsections only applies if you are offering building cleaning services. If this subsection does not apply to you, leave it empty. If this subsection applies to you, ask a tax advisor about it.

Section 18: Umsatzsteuerliche Organschaft (§ 2 Absatz 2 Nummer 2 UStG)

If you are not declaring a business association or a business partnership, leave this line blank. If you think this section applies to you, ask a tax advisor about it.

Section 19: Besonderes Besteuerungsverfahren “One-stop-shop”

In this section, you can choose to establish a One Stop Shop (OSS). A One Stop Shop makes it easier to sell to customers in other EU countries. If you plan to have more than 10,000€ per year in B2C revenue from other EU countries, check this box.

What is a One Stop Shop? – HelloTax

If you sell software on the Google Play Store or the Apple App Store, you don’t need to check this box. You are doing business with the app store, not with the customer. You don’t need to check this box.

If you don’t have customers in other EU countries, you can skip this section. If you are a Kleinunternehmer and you don’t charge VAT, you can skip this section.

If you are not sure, ask a tax advisor.

Für im Inland ansässige Unternehmer

This subsection is for businesses based in Germany.

- Ich nehme das besondere Besteuerungsverfahren (Mini-one-stop-shop) in Anspruch …

If you sell digital content (software, ebooks, apps) or digital services (web hosting, referrals, software as a service)14 to customers (not businesses) in other EU countries, you should probably check this box. - Ich habe keine Niederlassung in einem anderen EU-Mitgliedstaat und der Gesamtbetrag … der innergemeinschaftlichen Fernverkäufe … an … Nichtunternehmer überschreitet im laufenden Kalenderjahr nicht 10,000 Euro und hat dies auch im vorangegangenen Kalenderjahr nicht getan.

Check this box if…- You sell digital content and services to customers (not businesses) in other EU countries

- and the total revenue from those sales (without VAT) was under 10,000€/year this calendar year

- and the total revenue from those sales (without VAT) was under 10,000€/year last calendar year

- and you do not have a business branch in another country

- Die entsprechenden Umsätze werde ich im Inland … versteuern – I will pay taxes in Germany for this revenue

- Auf die Möglichkeit der Versteuerung der entsprechenden Umsätze im Inland verzichte ich für mindestens zwei Kalenderjahre … – I waive the option of taxing the corresponding domestic sales for at least two calendar years

- Ich werde das besondere Besteuerungsverfahren (One-stop-shop) in Anspruch nehmen (§ 18j UStG) …

Check this box if you want to declare a One Stop Shop (not a Mini One Stop Shop). This is new since summer 2021. - Die entsprechenden Umsätze werde ich direkt in den anderen EU-Mitgliedstaaten erklären – I will declare the corresponding sales directly in the other EU member states

Für in einem anderen EU-Mitgliedsstaat ansässige Unternehmer

This subsection is for businesses based in another EU country. This probably does not apply to you.

Section 20: Umsätze im Bereich des Handels mit Waren über das Internet

In this section, you explain if you will sell products and services online.

- Ich verkaufe über einen eigenen Webshop – I sell on my own online store

- Web-Adresse (URL)

The URL of your online store - Ich werde über eine/mehrere elektronische Schnittstelle(n) im Sinne des § 25e Absatz 5 UStG handeln … – I will trade via an electronic interface according to § 25e Abs. 5 UStG

Check this box if you will sell products or services on an online marketplace, online platform or online store. This includes platforms like Amazon and eBay.

Elektronische Marktplätze – Electronic marketplaces

In this section, you list the platforms on which you sell products and services, and your username on that platform.

Section 21: Gesondert einzureichende Unterlagen

In this section, you select the documents you will submit with your application.

Questions and answers

Is it hard to register a business in Germany?

Not if you have help. The registration form is all in German, and some questions are hard to answer. If you use Sorted, you can register your business in English, and the questions are simpler, but you still need to understand what you are doing. If you use a tax advisor, they do everything for you.

If you register a simple business, it’s still easy to do it yourself.

Need help?

If you have questions about this form, ask a tax advisor for help. They can fill this form for you. You can find one in our list of English-speaking tax advisors in Berlin. If you can’t afford a tax advisor, Sorted can help you fill this form in English for free.

Where ask business questions ➞

What to do next

Wait for your tax number and VAT number

In 4 to 6 weeks, you will receive your Steuernummer and VAT number (Umsatzsteuernummer) by post.7 Add these numbers to your invoices, and to the Impressum on your website. It’s required.

Tell your health insurance

If you have public health insurance, tell your insurer that you are self-employed. When you are an employee, health insurance comes directly from your paycheck. When you are self-employed, you must pay by bank transfer. The cost of your public health insurance will be based on your estimated income. Your health insurance will ask for your Steuerbescheid every year to prove your real income.

When you are self-employed, private health insurance is often better and cheaper. Think about switching. A health insurance broker can help you pick the best health insurance for your situation. I save over 400€ per month since I switched.

How to choose health insurance ➞

If you can, join the Künstlersozialkasse. They pay half of your health insurance. It’s always a good deal.

How to join the Künstlersozialkasse ➞

Find a tax advisor

If you are starting a business in Germany, get a tax advisor. They make your life much easier.

List of English-speaking tax advisors ➞

You can also use tax software like Sorted or Lexoffice to send invoices and make VAT declarations.

List of tax software for freelancers ➞

Some banks like Kontist, Holvi and Qonto can also make your accounting easier.

Sources and footnotes

-

Suat Göydeniz, tax advisor (December 2023) ⤴